What We Will Fight Over In the 2020 Campaign

It has only been a few months since the end of the 2018 U.S. campaign season. Nevertheless, we can already see what we will fight over in the 2020 campaign. We are already engaged in political and cultural warfare.

What Animates the Partisans

We have much more than the history of the past several decades to instruct us in what causes our present hostilities. In fact, history dating back to the Age of Enlightenment illuminates our causes of division.

In particular, history warns us to be very careful in the use of ideological terminology. Otherwise we will only succeed in confusing ourselves using terms with multiple meanings. If a term is used with different meanings during previous historical periods than is the case now, we should be extremely careful in how we employ it. This is especially the case with the labels “conservative” and “liberal” in the U.S. today.

So-called modern “liberals” who dominate the Democratic Party lost their right to be called liberals long ago. The original liberalism, invented by John Locke in the seventeenth century, was all about preserving the liberty of individuals from the threat of government tyranny. Modern day American “liberals”, in contradistinction, perpetually desire to increase government powers over the individual. They want increased powers to give government the means to solve social and economic problems. “Liberal” is a misnomer. Instead, left-leaning members of the Democratic Party are better described as “progressives.” There is a continuous ideological connection between the American progressive movement of the late nineteenth century, through the administrations of Woodrow Wilson, Franklin Delano Roosevelt, and later Democratic Party administrations. American progressivism is the U.S. version of dirigisme.

The progressive bête noire has always been the American corporation and the rich who invest in corporations. Since corporations are the fundamental institutions of capitalism, progressives have also been generally hostile toward capitalism. The American Left has always bought into one version or another of the “Iron Law of Wages.” This false economic law asserts companies and capitalists will pay their workers only the minimum necessary to keep them alive. In the progressive view, companies are the exploiters of workers, not their benefactors. They serve primarily as conduits of newly produced wealth to the richest capitalists.

Because they believe corporations are fundamentally nefarious and detrimental to society, progressives always seek new ways for government to regulate and control them. The ossifying effects of layer after layer of economic regulation throughout the West has brought long-term economic growth for many countries very close to zero. Until Trump, this was as true for the U.S. as for almost all of Europe.

In addition to increasing economic regulations, progressives delight in taxing away the income of corporations and their rich stock holders. They tend to believe government would make much better use of these assets anyway. In addition, they think redistributing the wealth through social programs would enhance social justice. This inclination to appropriate private assets for public use together with their fervor for a highly progressive income tax system has led them into serious errors.

Finally, American progressives believe deeply in their own virtue, knowledge, and wisdom. After all, they reason, do they not dominate academia and the news media? How could they do that if they did not have a more accurate vision of Reality than the American Right? Their political opponents are not just fundamentally wrong about Reality, but are positively perverse and wicked in opposing progressive programs. Progressives are constantly denouncing “conservatives” as racists, fascists, misogynists, xenophobes, and anything else that is evil.

So much for what animates progressives. What about their opponents, the so-called “conservatives”? Before we continue, I must satisfy my truth-in-labeling bias. “Conservative” is truly a misnomer for most of those who are so called. Both the American Left and Right have aspects of society they would like to conserve, and aspects they would like to change. They merely have different lists. A much more accurate label for most “conservatives” is “neoliberal.” As the term is used today, a neoliberal is a believer in classical liberalism together with free-market capitalism.

So what motivates the neoliberals of the Republican Party? More than anything else, neoliberals believe government seldom ameliorates problems. Instead, government usually makes our problems worse; many times much, much worse. As Ronald Reagan stated in his first inaugural address,

“In this present crisis, government is not the solution to our problem; government is the problem.”

Given their skepticism of government’s competence to actually provide solutions, one should not be surprised neoliberals want to minimize government’s societal roles. Instead, they have much greater faith in individuals, charities, and other specialized private groups. They would greatly prefer to have economic assets remain in private hands, where they tend to be used more wisely. In this they are the exact opposites of progressives.

In addition, neoliberals have a very honest, genuine fear of a power-hungry government evolving into a tyranny. We have seen this happen before in history. The Austrian economist Friedrich Hayek was a first-hand observer of the Weimar Republic evolving into fascist Germany. Since the political path to such a catastrophic collapse seems so universal, Hayek decided to record his observations in his 1944 book The Road to Serfdom. To a neoliberal, progressives seem to be pushing us down that road as rapidly as they can.

The Issues: What We Will Fight Over

Given the prime motivations of progressives and neoliberals, the campaign issues for 2020 seem almost inevitable. Democrats want to lead us to a government that dominates our social and economic lives. Republicans would lead us in exactly the opposite direction.

Let us start with the relative roles of companies and the federal government in the economy. Over the past two and a third years of Trump’s administration, the very partial deconstruction of the administrative state and tax reform have been treated as a catastrophe by Democrats. Both of those policy changes began the downsizing of the federal government’s social role. Both types of policy changes increase the economic power of companies and individuals. Consequently Democrats, given their animosity to corporations and free-markets, will propose to reverse both trends.

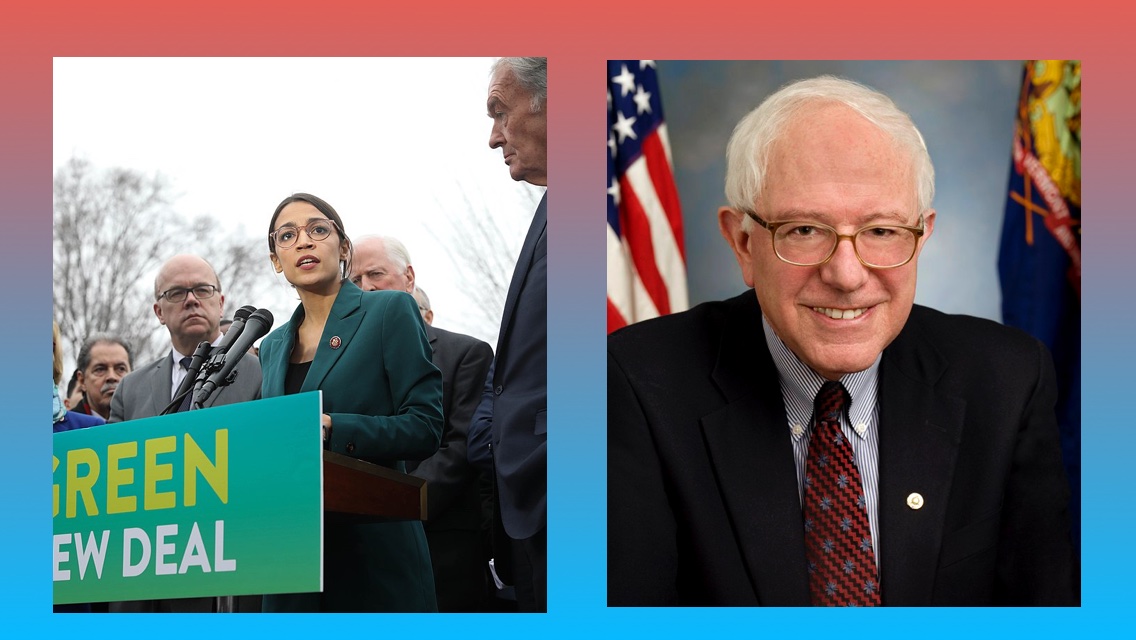

Concerning taxes, almost all Democratic politicians call not only for the repeal of the Republicans’ Tax Cut and Jobs Act, but also for a large increase of tax rates over what they were before that act. Rep. Alexandria Ocasio-Cortez (D-NY) would increase the top tax rate to 70%, Even more destructive to the economy would be taxes not just on income, but on assets as well. Elizabeth Warren would like an additional tax on wealth over and above an increased income tax. Specifically, she proposes an annual 2 percent tax on household net worth above $50 million, increasing to a 3 percent rate on net worth above $1 billion. Bernie Sanders would tax estates with a value above $3.5 million, and levy a 0.5% tax on stock trades and a 0.1% tax on bond trades. These progressive notions about taxes collide with Reality in several significant ways. Some of these ways will be pointed out in the last section, when we look at what history can tell us.

Progressives possess these proclivities about taxes partially because they want to punish the rich. However, their biggest motivation is they believe they can raise additional revenue for more and larger government programs. And what a humongous growth in government they are proposing! Their proposed Green New Deal alone would cost anywhere from $5 trillion to $10 trillion per year, depending on who you believe. So far, the Green New Deal is far too vague and amorphous to say for sure. One might tend to believe the upper number, since historically government programs always cost more than originally expected. However, suppose the lower number is closer to reality. With a current GDP of around $20 trillion, the Green New Deal would cost us a minimum of around one-quarter of our entire GDP annually!

Then there is the Democratic proposal for “Medicare-for-all”, or socialized medicine. A study from the Mercatus Center of George Mason University estimates the cost would be $32.6 trillion during its first 10 years. This price tag includes estimated savings from things like the elimination of employer provider payment cuts, administrative savings, and lower prescription drug costs. (See Table 1 in the study.) The cost of this program would then amount to around 16 percent of GDP above what is now being spent.

Medicare-for-all and the Green New Deal together would cost the U.S. at a minimum around 41 percent of GDP annually!

In addition to proposals for greater government management of various aspects of our economy, we will be fighting over how to handle the crisis at our southern borders. For a long time, Democrats have insisted that crisis was imaginary, manufactured by Trump for political purposes. However, as caravan after caravan of illegal immigrants from Central America arrived, the fact there was both a humanitarian and a national security crisis became undeniable. This obstructionist Democratic position became particularly untenable when Barack Obama’s DHS chief, Jeh Johnson, asserted the crisis was real.

Obama’s Department of Homeland Security Secretary asserts Trump is right. There is a southern border crisis.

Youtube / GOP War Room

The response of Democratic politicians has been primarily to blame Trump, and to propose policies to ease immigrants’ plights once they have entered the U.S. They are not willing to make illegal immigration more difficult. They are certainly not willing to fund Trump’s border wall. This response is despite the testimony by members of Customs and Border Protection and the Department of Homeland Security that walls have been extremely useful in stemming illegal immigration. Border security will almost certainly become a major issue in 2020.

Yet, Democrats hate Trump so much, they almost reflexively oppose any of his policies. This is particularly true about his immigration and border security policies. This brings us to progressives’ “Trump collusion delusion” and why they hate Trump. Now that Mueller’s report on Russian interference in the 2016 elections is publicly available, Democrats and their supporting media seem unable to let go of the collusion delusion. We are undoubtedly going to hear a lot more about this in the 2020 campaign.

Finally, you have probably noticed I have written almost entirely about Democrats’ positions in this section. This is because Republicans are not proposing a lot of new government policies and programs. You can expect them to bitterly oppose almost everything Democrats want. The GOP will campaign for the border wall and for infrastructure maintenance. Otherwise, they will push for more restrictions on government’s economic regulations.

What History Tells Us

History has not been kind to dirigisme in general, and to American progressivism in particular. Historical object lessons abound showing the folly of governments’ attempts to dominate their economies and societies. Here are some essays in which this is discussed:

- Historical Lessons on Economics and Politics

- More Historical Lessons From Europe

- Lessons From The Developing World

- All of the essays linked on my Economic Crises page

Demonstrations of the superiority of free-markets over government dominated economies are provided in the following essays.

- Comparing the Economies of All Countries on Earth

- The Human Development Index and Economic Freedom

- Are Leftist Economies Better Than Free-Markets?

- Comparing Economies of All Countries on Earth, 2018

When assessing the accuracy of each party’s arguments, everyone should find the historical record invaluable.

More recently, comparison of what happened during Obama’s administration versus Trump’s should be useful. First, let us consider real U.S. GDP growth rates during the two administrations.

St. Louis Federal Reserve District Bank / FRED

Unambiguously, the linear trends show long-term real growth rates decaying during Obama’s regime, but rising during Trump’s. Many progressives have tried to explain this disparity away as the result of a transient “sugar high” caused by Republicans’ tax cuts. Yet, the imminent economic recession those folks predicted appears to be nowhere in sight. Rather than just fueling temporary consumption, the tax cuts along with economic deregulation have stimulated increased business investment to increase productive capacity. This can be seen in manufacturers’ new orders for nondefense capital goods.

St. Louis Federal Reserve District Bank / FRED

Again, we can see capital goods investments under Obama were declining, but are increasing during Trump’s administration. A related statistic is new orders for durable goods.

St. Louis Federal Reserve District Bank / FRED

Suppose companies were increasing productive capacity and manufacturing all these new durable goods, but those goods were just piling up in inventories. Then the statistics really would be evidence only of a “sugar high”. We can disabuse ourselves of this notion by plotting how the inventory-to-sales ratio is changing with time.

St. Louis Federal Reserve District Bank / FRED

Clearly, the inventories relative to sales were increasing under Obama, but decreasing under Trump. Since demand is now outpacing production, we can not be in a “sugar high”. Our higher economic growth is not transient.

Economic history can tell us one more thing about the relative merits of progressive and neoliberal ideas about taxes. I stated earlier that progressive notions about taxes collided with reality in significant ways. Democrats would like to make taxes on companies much higher, and to make individual tax rates considerably more progressive to squeeze the rich. As I noted in the post Curious, Erroneous Progressive Ideas About Taxes, this situation leads to a law of economic behavior called Hauser’s Law. What it says is that no matter what the maximum marginal tax rate, federal tax revenues will always be 19.5 percent of GDP, plus or minus a couple of percent. This has been true since the 1940s, and can be demonstrated in the following graph.

Hoover Institution / W. Kurt Hauser and David Ranson

The implication is federal revenues can increase only if the GDP increases. Merely increasing the maximum tax rate on the rich will not increase the federal government’s share of GDP.

The foregoing seem to be the major issues we will all fight over in 2020. This coming campaign season promises to be highly vitriolic, emotional, and immensely interesting.

Views: 2,999