The Problems with the Coronavirus Aid Package

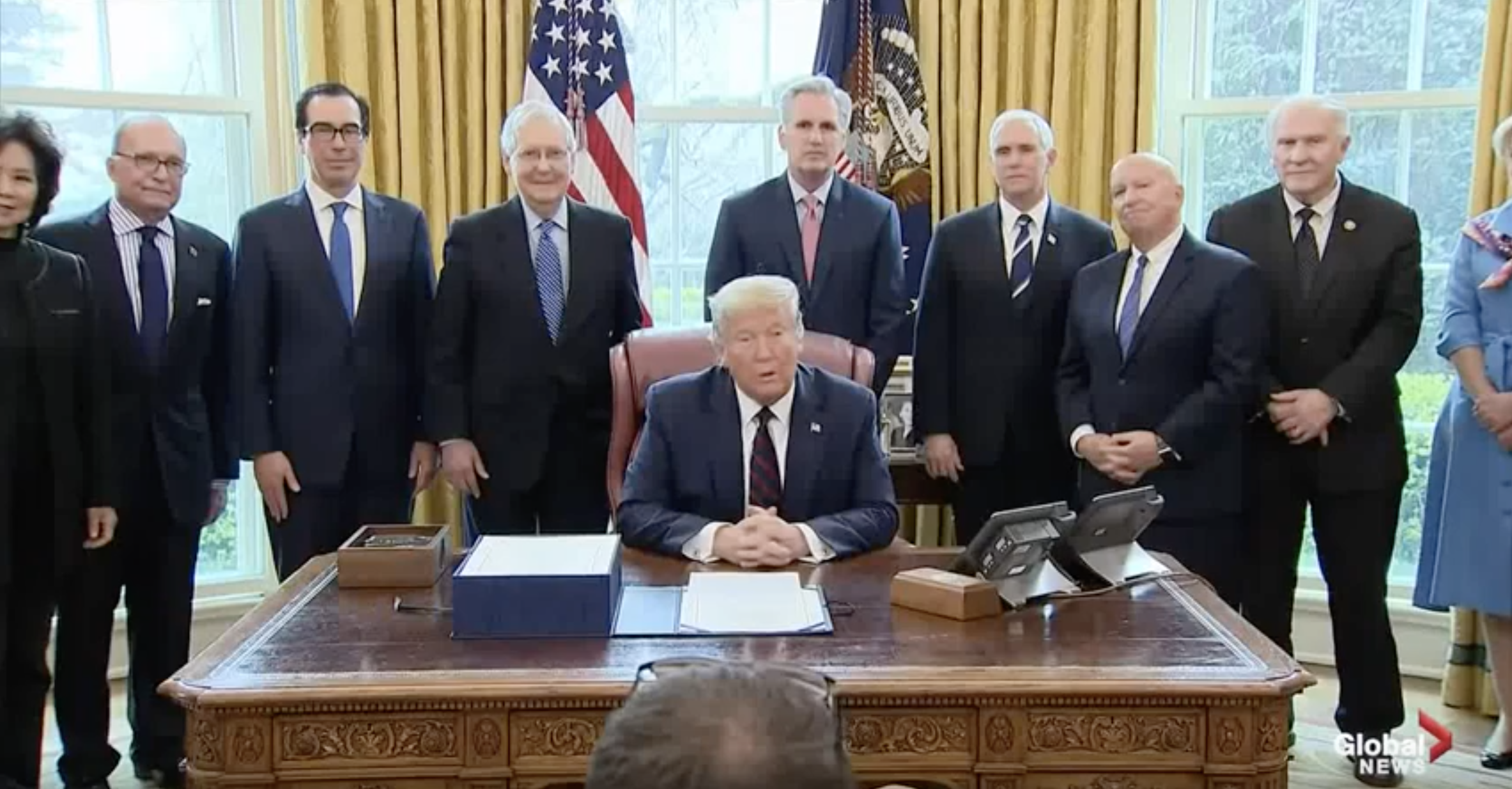

Recently, Congress passed and the President signed the Coronavirus Aid, Relief, and Economic Security Act, which also is called the CARES Act. It was designed to rescue the financial lives of businesses and individuals from the scourge of the COVID-19 epidemic. Nevertheless, there are numerous economic problems created by the epidemic that are not addressed by this act. In the end, it might become only a palliative for the economy.

What the CARES Act Does

Absent a vaccine or other effective cure, all we can do to stop the Coronavirus spread is to separate the sick from the healthy. Since the virus has an approximately two-week incubation period, many people apparently healthy will be infected and able to spread the disease. Therefore, as much as possible, we must separate everyone from everyone else. The results of this necessity are the various “social distancing” protocols (stay at home as much as possible, stay at least six feet away from others, wear face masks when going out, etc.) and the wholesale shutdown of “unessential” businesses.

What is considered an unessential business varies from state to state, as it is the state governments that have issued the “lockdown” orders on businesses. This diffusion of responsibility among the states can be a great advantage, as the prevalence of the disease is quite different in the various states. However, this might require a degree of coordination between them, which might be encouraged by the federal government.

By shutting down commerce through lockdown orders, the states have created a huge demand shock. Laid-off or furloughed employees have lost their incomes. So have companies who no longer produce products for sale.

The primary purpose of the CARES Act is to counteract this demand shock created by the epidemic. The major provisions of this law are the following:

- Aid to Individuals

- Direct Payments: Tax-paying citizens will receive a one-time direct deposit of up to $1,200, with married couples receiving $2,400. Parents with children will receive $500 per child. Payments will not be given to individuals with incomes above $75,000, or to couples with incomes above $150,000.

- Extended Unemployment Benefits: $250 billion is allocated for extended unemployment benefits. The program would provide unemployed workers $600 per week in addition to state unemployment benefits. These extended benefits are also available to the self-employed, independent contractors, and gig workers.

- Use of retirement funds: The 10% early withdrawal penalty for distributions up to $100,00 is waived if the withdrawal is for coronavirus-related purposes. The withdrawals will still be taxed if the taxpayer does not redeposit the withdrawal within three years. Otherwise, those taxes will be spread over three years. The loan limit on 401(k) loans is increased from $50,000 to $100,000.

- RMDs suspended: The Required Minimum Distributions after age 72 from IRAs or 401(k) funds are suspended.

- Aid to Companies

- Company payroll taxes: Employers are allowed to delay payment of their portion of 2020 payroll taxes until 2021 and 2022.

- Small business relief: The act provides $350 billion to prevent layoffs and business closures. These loans are provided to companies whose employees are required to stay home during the coronavirus epidemic. Up to eight weeks of loans are available to companies with 500 employees or fewer and which maintain their payroll. If the employers do maintain their payroll, the part of the loans used for payroll costs, interest on mortgages, rent, and utilities would be forgiven.

- Large corporations: The act provides $500 billion for loans, loan guarantees, and other investments. The inspector general of the Treasury Department will oversee this aid. Loans will not last longer than five years, and they cannot be forgiven. As a special case, out of the total $500 billion airlines will receive $50 billion for passenger flights and $8 billion for cargo flights.

- Agriculture: The Agricultural Department can increase the amount it can spend on its bailout program from $30 billion to $50 billion.

- Aid to Governments and Hospitals

- State and local governments: $150 billion will be provided to state, local and tribal governments. From this, $30 billion will be given to state governments and public educational institutions, $45 billion is set aside for disaster relief, and $25 billion for transit programs.

- Hospitals and health care: More than $140 billion will be spent to support the U.S. health system. Of this, $100 billion will go to support hospitals. All of the rest will go to provide vital supplies to support healthcare workers (personal protective equipment, testing supplies, and increased workforce and training), accelerated Medicare payments, and support for the Centers for Disease Control and Prevention (CDC).

- Coronavirus testing: Testing and potential coronavirus vaccines will be provided at no cost to patients.

Note that almost all of the aid from this act, especially that directed to individuals and companies, is provided to mitigate the loss of demand for their goods and services. This is classically Keynesian, “pump-priming” federal government expenditures. The aid to local and state governments, and to hospitals and healthcare does support the production of services. However, that accounts for only about $290 billion out of a $2 trillion program. Yet, the economic challenge of the COVID-19 epidemic is at least as much a collapse in economic production, i.e. to a humongous supply shock.

The Economic Challenge of COVID-19

The problem with the CARES Act is that it addresses only the demand shock created by the epidemic. As businesses are shut down and workers are laid off, both businesses and individuals lose the income they need to sustain their usual economic activity and demand falls discontinuously.

However, that same economic shutdown also stops the production of many things the economy would otherwise demand. Before goods can be consumed or offered for sale, they first must be produced. This is a problem the CARES Act cannot address.

However, the coronavirus epidemic simultaneously forces an equally severe supply shock. The immediate cause of the demand shock is the loss of incomes to both individuals and companies due to the total shutdown of many companies. However, that same economic shutdown also stops the production of many things the economy would otherwise demand. Before goods can be consumed or offered for sale, they first must be produced. This is a problem the CARES Act cannot address.

All the CARES act does is to maintain economic demand by companies and individuals by giving them government money. As long as companies are not allowed to produce their goods and services, many of those goods will not be available no matter what the demand.

So what is the result of maintaining economic demand while reducing goods and services? Let T denote this year’s GDP in this year’s dollars, and t denote the same GDP in the constant dollars of some base year. The two are related through a price index, P. Also, if M is this year’s average money supply, then by definition of the velocity of money V, we must have

The velocity of money is the average number of times a dollar changes hands during the current year.

For any quantity x that changes in time, suppose we denote its change from the previous year as Δx. Then we can show

The fractional change in the price index (times 100%) is what is meant by the inflation rate. What the equation above tells us is that inflation increases with an increase in the money supply and with an increase in the velocity of money, but decreases with an increase in GDP. If the money supply increases a huge amount through the new CARES aid, while GDP decreases greatly (negative fractional change), then what is predicted is a large increase in inflation. In addition, as people begin to expect higher inflation, they will usually increase the velocity of money. They will want to get rid of their old dollars through purchases before those dollars’ value decreases further. That would also increase inflation.

For a more thorough view of the monetarist theory of inflation, see my PDF Elementary Inflation Theory. In addition, for the economic effects of inflation, see the post How Big A Problem Is Inflation for Stock Markets?

To avoid the destructive effects of inflation, we must act simultaneously to maintain supply. Needless to say, we cannot do this so long as businesses remain shutdown. Somehow, we have to get America back to work.

Views: 2,274