Major Problems for the Republican Party

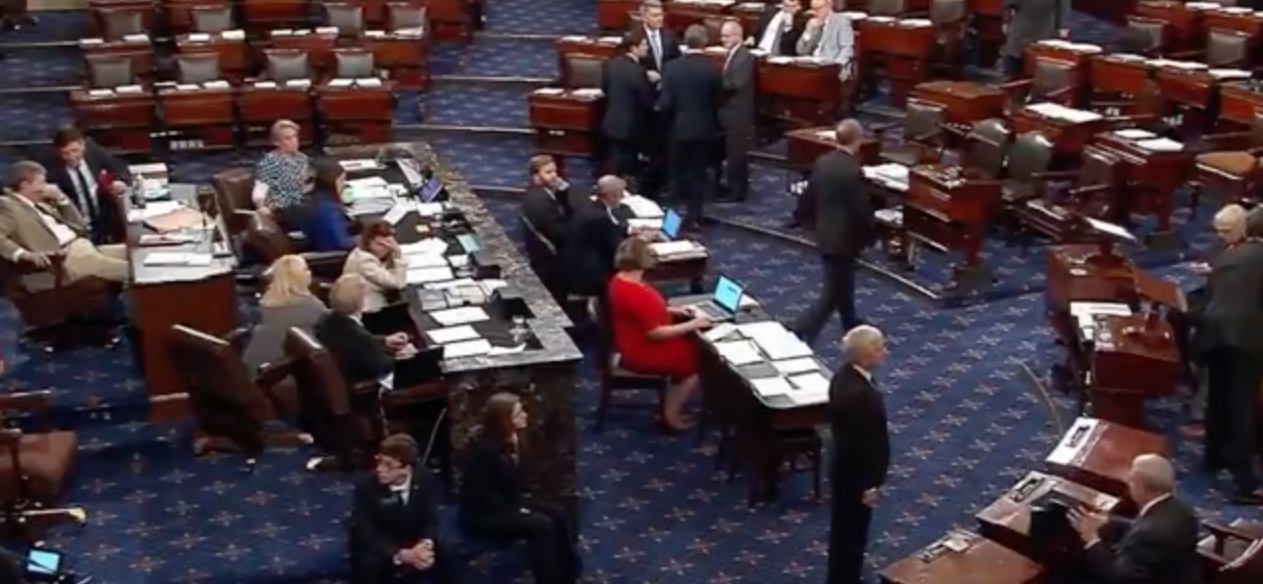

The U.S. Senate voting NO on repeal of Obamacare on July 27, 2017.

Screenshot of ABC News coverage.

Everywhere the leaders of the two major American political parties look, insuperable political problems threaten to overwhelm them. As long-time assumptions about the capabilities of government unravel and the electorate itself is fragmenting into new coalitions, driven by uncertainty on how their major economic and political problems can be solved, the parties themselves are frustrated over how to get public support for their policies. The Republican Party especially appears to be splitting into separate moderate and “conservative” coalitions. However, although the Democratic Party (at least among its elites) is not so riven as the GOP, its relatively greater unity is driving them in a direction that threatens to alienate even more of the electorate. How are the not-so United States of America and its people going to get themselves out of this fine mess?

The Congressional Republican Party

Since the Republican Party is (supposedly) the governing party, let us take a look at their apparently insuperable problems first. I will examine the Democratic Party’s problems in my next post. Foremost among the GOP’s dilemmas is their dysfunctional division in the two houses of Congress. As we have all read and seen from the news, there seems no way for the GOP to find agreement between moderates and so-called “conservatives” (actually neoliberals) in the U.S. Senate on repealing Obamacare, let alone replacing it. It was hard enough finding enough agreement between them in the House of Representatives to pass a healthcare bill.

A large part of the problem arises from the very narrow Republican majority in the Senate. Holding only 52 Senate seats, with the Democrats possessing 46 and independents caucusing with the Democrats having 2 (one seat is vacant), the GOP can afford to lose only two Republican votes on any vote. This of course is only on those votes deemed to be for a budget reconciliation bill that is exempt from a filibuster. Otherwise, to pass a bill the GOP would have to muster 60 votes, which they do not have, to invoke cloture on a Democratic filibuster. In this hyper-polarized political environment, one would expect the Democratic senators to filibuster almost any bill supported by most Republicans.

Yet it is still striking so many GOP senators and some House members are opposed to a full repeal of Obamacare. There were good reasons why during all of Obama’s administration Republican congressmen had pledged to repeal Obamacare. The high cost of deductibles for the middle class often made Obamacare policies unusable except as catastrophic health insurance. In addition, to have this privilege, policy owners would have to shell out increasingly larger sums for premiums. Besides Obamacare’s bad effects on the availability of health care, there were in addition its disastrous effects on small businesses. The high cost of Obamacare has motivated many small businesses to hold the number of their full-time employees to below 50 to avoid the need to offer Obamacare compliant policies. This economic effect could hardly have come at a worse time, when the economy had entered a state of what many call “secular stagnation.”

Now, with costs spiraling out of control, Obamacare has entered its long-predicted death spiral, with insurance companies leaving the system in many state markets. So why have so many GOP congressmen balked at repealing many provisions of Obamacare? Part of the answer appears to be fierce constituent resistance by some against total repeal, and part of it seems to be a greater ideological diversity among Republican congressmen than one might have suspected. Yet another part of the answer comes from the nature of Trump’s winning constituency last November. Many of the blue collar workers who defected from the Democratic Party voted for Trump because they felt the Democratic elites had abandoned them, but they still have enough faith in government to believe government programs can help them. The Los Angeles Times quoted Lee Drutman, a senior fellow at a Washington-based think tank called New America, who said, “There are a lot of people who voted Republican because of cultural and identity issues, but who want government programs that help them.” Having enticed those voters to cross over and change party affiliation, some GOP congressmen who have them as constituents may be struggling mightily to keep them.

Watching this struggle within the Republican Party over healthcare, one is inevitably led to the thought that the GOP is actually a loose confederation between two other parties. One of these parties is moderate and not quite progressive, while the other is neoliberal (aka “conservative”). As long as the moderate faction is a non-negligible fraction of the GOP, and as long as the Republicans have only a razor-thin majority in the Senate, an actual repeal of Obamacare would appear to be beyond reach.

If Obamacare is not repealed, it is highly unlikely the moderates will be able to persuade the neoliberals to do anything to shore up the failing health program. What is most likely then is Obamacare will be allowed to just totally fail. What happens subsequently will depend on how the American electorate reacts to this catastrophe, and who they next send to Congress.

None of this division among Republicans is promising for other legislative accomplishments, particularly for an even more important part of the Republican agenda, namely tax cuts and reforms for the middle class and corporations. Without giving more say to consumers and companies, i.e. to the free-market, to allocate the economy’s resources, economic growth will continue to be stultified by government distortions. This is one of the primary reasons for the secular stagnation during the Obama era.

Richard Rubin, a U.S. tax policy reporter for the Wall Street Journal, wrote this week that

. . . there are reasons to think a tax overhaul could be easier than health care. Republicans have more common ground, ideologically, and they won’t be quite as bedeviled by Senate rules complicating passage of nonfiscal legislation. And the White House has been articulating clearer principles and showing deeper, more consistent interest.

One of the biggest obstacles dividing Republicans over tax reform was a House proposal for a border adjustment tax (BAT), in which tax deductions for imported goods would be eliminated, while profits from exports would be exempted from taxation. House leaders like Speaker Paul Ryan (R-WI) and House Ways and Means Committee Chairman Kevin Brady (R-TX) proposed it as a means of defraying large corporate and middle class tax cuts, while at the same time encouraging American exports and discouraging imports. In addition, the Tax Foundation, a Washington think-tank, estimates the Republican proposal would raise about $1 trillion over a decade’s time. This was important since it was just about the only politically palatable way to keep the whole tax plan, including large corporate and middle class tax cuts, revenue neutral.

Many Republicans have vigorously opposed a border adjustment tax as a mercantilist measure that would counterproductively raise the costs of all imported goods. News this week seems to indicate this controversy is being removed in congressional negotiations. The WSJ’s Richard Rubin reported,

The so-called Big Six—a team of negotiators from the Senate, House and Trump administration—released a set of principles Thursday that entailed lower tax rates and simplification of the tax code while omitting the House’s “border adjustment” plan for taxing business income. A border-adjusted tax would have exempted exports while taxing imports.

The Business Roundtable, a group of corporate leaders that had largely sat on the sidelines because its members were divided on border adjustment, announced a multimillion-dollar ad campaign on Friday aimed at making the case that lower corporate tax rates would boost economic growth. Conservative groups that had criticized border adjustment, including those tied to the billionaire Koch brothers, are working more closely with the administration. Representatives from the groups are holding a public event in Washington on Monday to promote the tax plan alongside Treasury Secretary Steven Mnuchin and White House Legislative Affairs Director Marc Short.

However, this development raises the possibility of an even larger problem, the reason why House leaders had proposed the border adjustment tax in the first place. Having rejected this tax and having lost the large savings that would have accompanied the repeal of Obamacare, enacting large corporate and middle class tax cuts could blow a hole in the federal budget. The hole might be filled with increased economic growth causing increased taxes from a larger GDP. Nevertheless, Senate rules assume “static scoring” when determining how a tax reform bill is to be treated. The importance of this is explained in an Atlantic.com post entitled Who’s Afraid of a Big BAT Tax?.

It’s a question of Senate math. To pass with a simple majority (and avoid a filibuster by Democrats), the GOP’s plan must go through under the procedure known as reconciliation. But to qualify for reconciliation, the package–which slashes both corporate and upper-bracket taxes–cannot blow a hole in the long-term budget. Without the $1 trillion in revenues from BAT, say advocates, there’s no way that hole can be plugged.

“This is the only way at these rates and keeping things revenue neutral,” insisted a senior Republican aide. There is no other viable option. Period. End of story.

Therefore, to pass any tax reform at all that cuts the total tax burden for all companies plus the middle class, either the BAT or some other tax must must be raised to keep total revenues approximately the same. Otherwise, the Senate rules for reconciliation with the budget resolution would not be met and debate would not be limited to 20 hours. Without something like the BAT in a tax reform bill, the Democrats could filibuster the bill to death. It is hard to see how this barrier could be overcome without entirely removing that Senate institution known as the filibuster.

The Republican President

A second, somewhat lesser headache is the sometimes boorish, sometimes incompetent, and always narcissistic leadership of President Donald J. Trump. Our non-traditional president seems to excel in shooting himself in the foot and distracting attention from the main issues of his agenda. It does not help that the majority of the media that is progressive-allied is constantly trying to implicate him as a Russian agent to inspire impeachment proceedings. Rather than ignore such idiocies, completely unsupported by evidence, Trump is constantly driven by his narcissism to strike back, often in foolish ways. Recent examples include the appointment of Anthony Scaramucci as the administration’s director of communications strategy and messaging, Trump’s castigation of his Attorney General Jeff Sessions for his recusal from the Russia investigation, and the driving out of Reince Priebus as his chief-of-staff.

Scaramucci was apparently recruited for a mission to close any leaks within the Executive Office of the President. He immediately disgraced himself by accusing Priebus of committing a “felony” by leaking Scaramucci’s Office of Government Ethics forms. Scaramucci tweeted to the world,

In light of the leak of my financial disclosure info which is a felony. I will be contacting @FBI and the @TheJusticeDept. #swamp @Reince45

which is as good as an accusation. As it turns out, these forms are publicly available disclosure forms, and were obtained by Politico from the U.S. Office of Government Ethics by request.

Trump’s frustration at the attempts by the progressive media and the Democratic Party to label him as a minion of Russia is very understandable, but that is not an excuse for such disgraceful behavior. His treatment of his AG Jeff Sessions is particularly despicable. Sessions was a loyal supporter of Trump almost from the very beginning of Trump’s campaign, and Sessions’ recusal from the Russia election meddling investigation was dictated by law and long-established Justice Department policy. If Trump is to expect loyalty from his followers, he has to learn that loyalty must go both ways. Otherwise, he can not demand sacrifices and expect to get them.

Having delivered these considerable criticisms of our unusual president, one has to admit Donald Trump shows signs of growing in the office. I have written before of Trump’s ignorance and his underdeveloped personal ideology. However, Trump has also shown that he is not a stupid man, and he is uniquely placed to give himself a force-fed education on public and economic affairs. By all accounts, Trump is a good listener and attentive to the views of others, if only in private. Certainly, the choices he has made in his cabinet appointments and his changes through presidential executive orders have been heartening. We can only hope he continues his education.

As bad and insurmountable the political problems faced by the Republican Party are, they pale before the long-term problems of the Democratic Party. I will take a look at those in my next post.

Views: 4,342