Curious, Erroneous Progressive Ideas About Taxes

Differing views about taxes generate much of the anger between the American Left and Right. Progressives, insisting government should be the major tool for solving social and economic problems, look for any opportunity to raise taxes. In their view, government requires increasing control of the nation’s assets to do its job. Contrariwise, neoliberals (often mislabeled “conservatives”) greatly desire limiting government’s role and the economic assets given it.

Historical Progressive Biases

For more than a century, progressives have held antagonistic attitudes toward capitalism. This hostility was generated by their hatred of private corporations. Ever since the progressive movement began in the late nineteenth century, American progressives have considered large companies to be exploiters of the people. Rather than viewing companies as the primary creators of wealth and jobs, those companies were considered mostly conduits of wealth to the privileged elite.

Wikimedia Commons / Library of Congress

Much of this hostility was inspired by Malthus’ and Ricardo’s “Iron Law of Wages.” This so-called law asserted companies’ owners had no incentive to pay more than subsistence wages. It declares that real wages will always trend toward the minimum required to keep the workers alive. A modern version of this idea was revived in recent years by the French socialist economist Thomas Piketty. Both versions of this faux law prove false for exactly the same reason: Skilled labor is itself a scarce economic resource. So long as investments, increasing technology, or some other factor causes economic growth, companies will bid up wages to attract skilled labor away from other companies.

Nevertheless, despite the historical record, progressives persist in believing newly produced wealth will always flow mostly toward the very rich. The rich will always grow richer and the poor poorer. Reality, however, is somewhat more complicated. Averaged over time, the rich do become richer, but then so do the poor. This fact will be discussed more in the last part of this essay.

Given these prejudices, progressives have always advocated larger taxes, especially on the richest. Partly, this support for higher taxes reflects their view government must have increasing resources for solving social problems. Proposals for a jobs guarantee, a Green New Deal, and Medicare-for-all would be incredibly expensive. However the desire for higher taxes is also inspired by a desire to punish the rich for exploiting the poor and the middle class.

Recent Progressive Ideas About Taxes

Ever since passage of the Tax Cut and Jobs Act in December of 2017, progressive Democrats have been howling about its injustice. Universally, Democrats would rejoice at its repeal. Rep. Alexandria Ocasio-Cortez (D-NY) declares the top marginal income tax rate should be raised to 70 percent. Sen. Elizabeth Warren (D-Mass) has an even wilder idea. She would like an additional tax on wealth over and above an increased income tax. Specifically, she proposes an annual 2 percent tax on household net worth above $50 million, increasing to a 3 percent rate on net worth above $1 billion.

Should these ideas actually be adopted, their predominate effect would be to reduce capital invested for increasing the nation’s productive capacity. If investments were reduced below replacement investment requirements, the nation’s economic output would literally contract. This is the direction in which most of the West has travelled for the past several decades.

Reality’s Contradictions

The Left’s notions about taxes collide with Reality in several different ways. For example, the progressive predilection for punishing the rich results in much higher tax rates for the rich. In 2018 the top 20 percent in income received 52 percent of U.S. total income, but paid around 87 percent of income taxes. The lowest 60 percent received about 27 percent of total income, but paid essentially no net federal income tax.

Image Credit: Wall Street Journal

This severely progressive tax structure has enormous consequences for the U.S. Almost all federal income tax revenue comes from the top 20 percentile. This implies that revenue is limited to a fraction of the 52 percent of total income earned by the top 20 percentile. As a fraction of GDP, it is even smaller still. This is because much of GDP is not personal income, but is retained by corporations for investments. The result is something called Hauser’s Law. Ever since the 1940s, total U.S. tax revenues have been around 19.5 percent of GDP, plus or minus a few percent.

Wall Street Journal / David Ranson

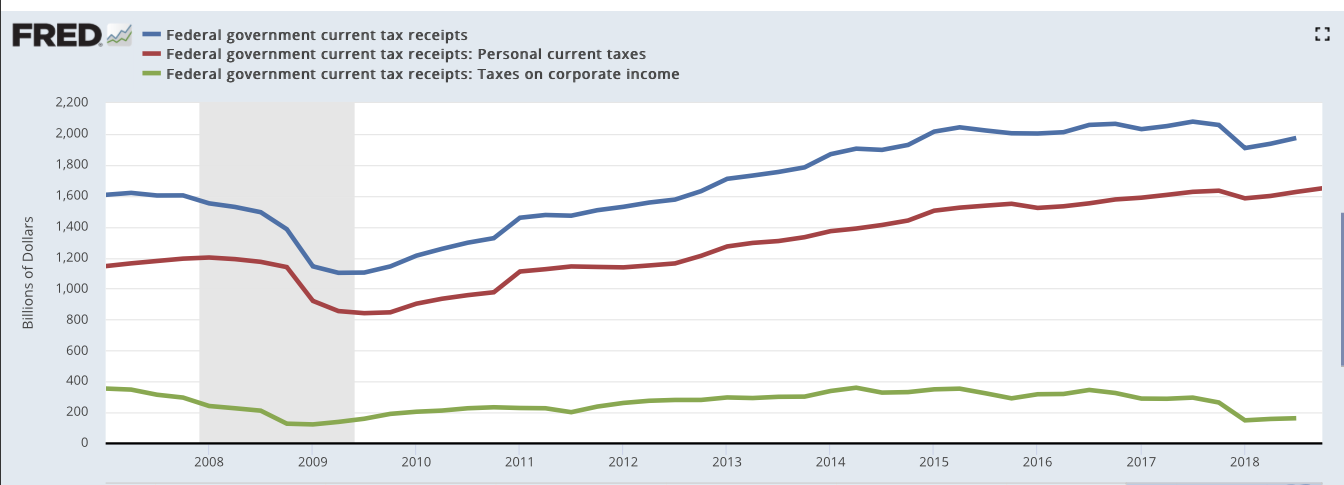

Nevertheless, that 19.5 percent of GDP taken by the government has increased greatly in time, as shown in the graph above. That, of course, is because the GDP has grown so much. This remarkably constant relationship between total tax revenues and GDP has been quite independent of the top individual tax rates, as shown in the graph below.

Hoover Institution / W. Kurt Hauser and David Ranson

What all this tells us is that if you truly want to increase government revenues, you must do everything you can to increase the size of the GDP.

This reasoning is completely dependent on the highly progressive structure of U.S. tax rates. A friend once suggested to me that Hauser’s Law could be repealed. After all, many European nations tax around 40 percent of national income. Yet to do that, they must levy the maximum tax rate on the lower middle class. To repeal Hauser’s law, the U.S. would have to abandon the highly progressive structure of tax rates.

All of this leads us to the fundamental inconsistency in the Democratic Party’s tax policies. In keeping tax rates so highly progressive, the only way federal tax revenues can increase is if the GDP increases. Yet increasing tax rates on companies and the very rich also decreases investments in future productive capacity. This depresses future economic growth, and therefore growth in tax revenues. If the Democrats discourage individual and corporate investment enough, they will only succeed in actually shrinking GDP and contracting federal revenues. How will they pay for their Green New Deal then?

Views: 2,191