Why Have ZIRP and QE Failed?

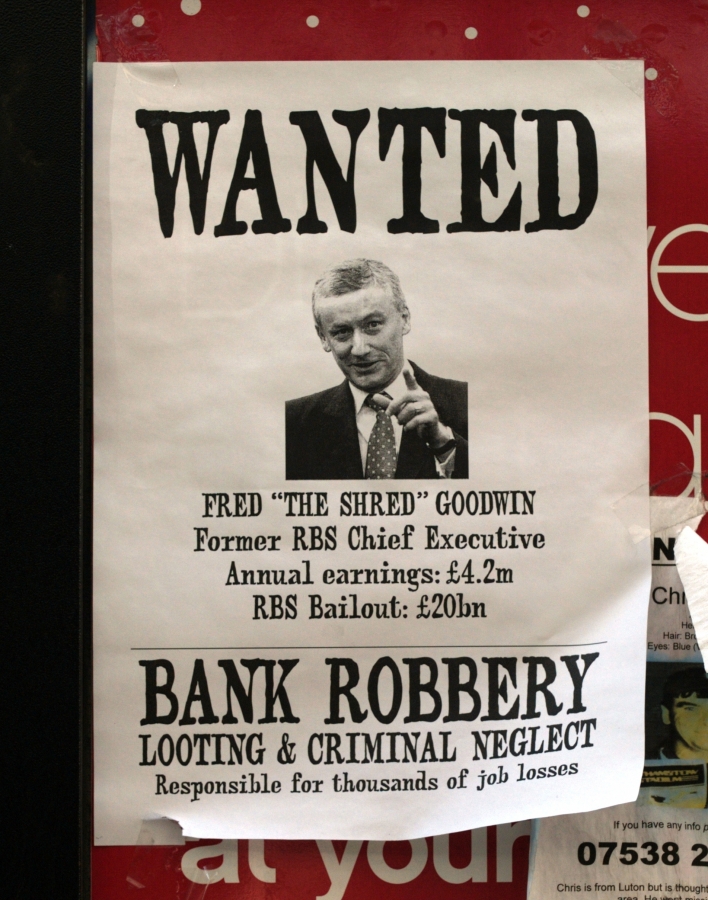

Wanted for Bank Robbery Photo Credit: Flickr.com/takomabibelot

By now after roughly six and a half years of a Zero Interest Rate Policy (ZIRP started in December 2008), and an almost equal amount of time of Quantitative Easing (QE1 started in late November 2008), we should all be able to agree they have been complete failures in stimulating our low growth economy. How big a failure have they been? Consider the following chart comparing the GDP growth of recent recoveries, with the yellow curve representing our present recovery.

Image Credit: Wall Street Journal

First, it should be obvious from the chart that the current recovery is distinctly subpar. In fact, one can credibly claim this has been the worst recovery since the one following the Great Depression, although the Wall Street Journal has pointed out the double dip recession caused by Paul Volcker’s choking of inflation to death was comparable. At least as important for our purposes is the observation GDP growth has been an almost equal amplitude oscillation about a long-term average of around 1.7%. If ZIRP and QE had any efficacy at all, we should be able to see a movement of the center of oscillation upwards. We can only conclude that ZIRP and QE have had no perceptible effect on GDP growth. As you would suspect, this is not a unique observation, but has been made by many others. For example, see here and here and here and here.

Before we go further, allow me to make a point about nomenclature. It is often ambiguous in articles just what the difference is between the two terms ZIRP and QE. Two alternative views are possible. In the first ZIRP is seen as the policy of using conventional central bank methods to lower short-term interest rates, while QE is the unconventional technique of lowering long-term rates by buying long-term government bonds and mortgage-backed securities. In the second interpretation ZIRP is the overall program of lowering all interest rates both short-term and long-term, while QE is the program for lowering the long-term rates. Because of its greater clarity, we will use ZIRP to mean the program for lowering short-term rates and QE to mean the policy for lowering long-term rates.

However, given the naked fact that ZIRP and QE have failed, it would be very useful to know exactly why and how they failed. People have thought of several ways by which ZIRP and QE could become counterproductive, and I have listed the ones I think most interesting and probable below.

- If the Fed keeps real long-term interest rates at zero, people of retirement age who normally would have shifted their retirement savings from stocks to fixed income, high grade bonds for safety of their nest-eggs, instead either keep their money in stocks with higher risk than bonds, or they keep their assets in cash. With no bond income, the retired must spend their capital to live. This means there will be a smaller amount of capital available in credit markets for productive investment. It also means that as their capital, on which they live, decreases, the retired become a great deal more frugal. Overall demand goes down, which implies deflation and reduced economic activity.

- Real long-term rates of zero help to finance government deficit spending. Since the national debt is about 103% of GDP, the government claim on physical assets added by deficit spending is beginning to crowd out competing claims by commercial businesses. This causes less productive capacity, imbalances of supply and demand that create more unemployment and deflation.

- A bad economic environment caused by government regulations (see Economic Effects of the Dodd-Frank Act, The Burden of Government Regulations, and The EPA, CO2, Mercury Emissions, and “Green” Energy), taxes, and Obamacare, created by the Obama administration, together with low interest rates causes low investment in productive capacity by companies, but high borrowing to buy-back stocks. This causes low productivity and output, low employment, low wages, and the inflation of a stock asset bubble. This implies deflation and lower output. Similarly, low long-term rates encourage borrowing to buy real-estate, which helps to inflate a real-estate bubble.

- A real drop in incomes among the middle class causes families to become more frugal and spend less. This implies deflation and reduced economic activity.

- A worldwide approach to corporate taxes has caused multinationals to park $2.1 trillion overseas, not to be used for investment in the U.S. for productive capacity and new jobs. This causes job-anxiety and frugality in the middle class. This point is actually independent of monetary policy,but it emphasizes and reinforces point number 3.

The first three of these effects are definitely implied by low interest rates, and the last two act to reinforce the effects of the first three.

The first three items in the list above are effects one should definitely expect with extended real interest rates, especially long-term rates, of zero. In this way the combination of ZIRP and QE become counterproductive and exercises in futility. These considerations certainly help to explain why ZIRP and QE have so obviously failed. We should all give up the hope that an expansive monetary policy as required by ZIRP and QE can stimulate our economy at all. The best change that could be made to rectify these problems is to have the Congress reduce the Fed’s mandates to the one of maintaining the value of the dollar, and to adopt a monetary rule to achieve 0% inflation or deflation.

Views: 3,295