What Progressives Don’t Get About Wealth Creation and Corporations

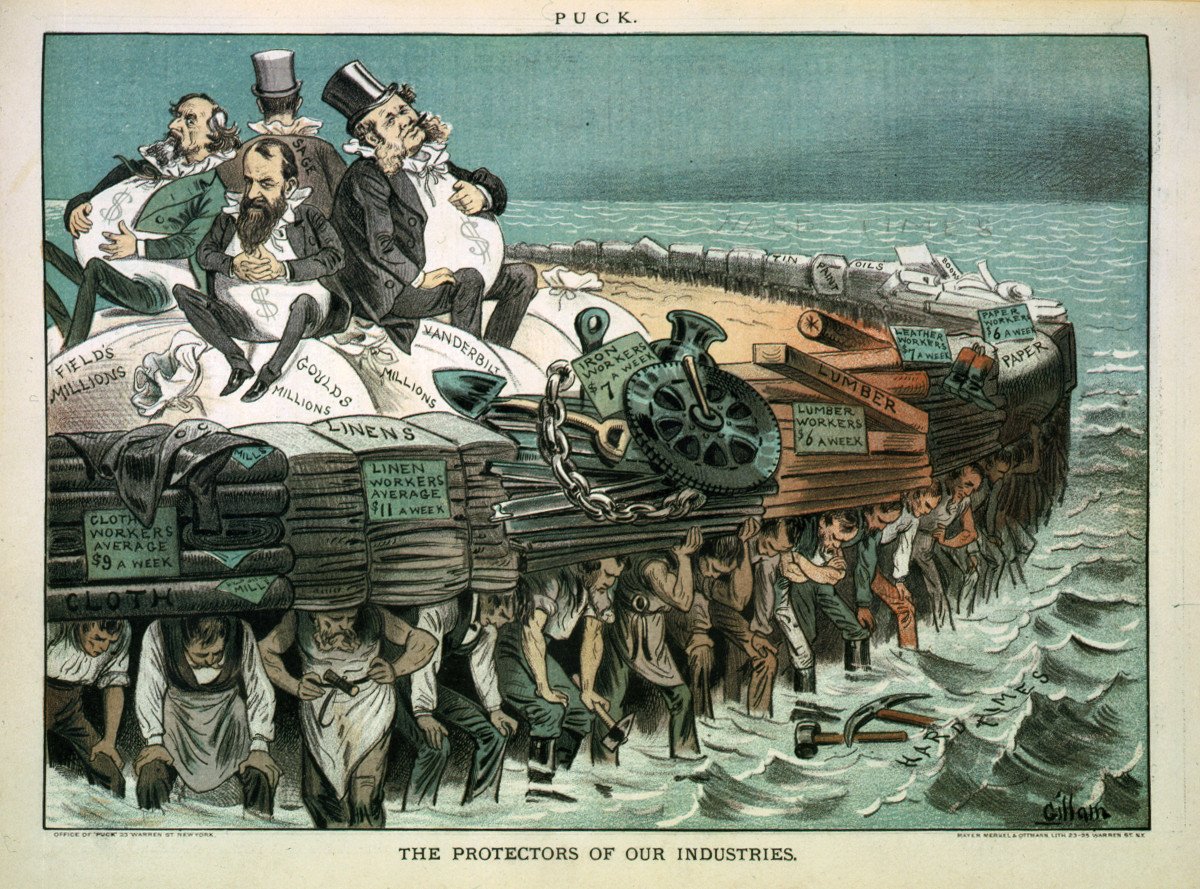

The progressive view of American corporations dating from the late 19th century. The Robber Barons, seated on bags of millions of dollars, are supported upon the backs of the workers.

Wikimedia Commons / Puck Magazine Source: Library of Congress

Progressives have always had a hate affair with corporations. From the very beginning of their movement in the late 19th century, they have despised corporations as the enemies of the people. At first, they might have had a small point in making this claim. When corporations were able to form monopolies and fix prices, they could subvert free-markets to the detriment of everyone. However, even in the modern age when these practices have been outlawed, the American Left continues this fixation.

The Left’s View of Corporations and Wealth Creation

Since the American progressive movement first began in the late nineteenth century, people belonging to it hated corporations. In the progressive view, companies existed to exploit workers, to take the fruits of their labor and return back a pittance for wages. Clearly, they accepted wholesale Malthus’ and Ricardo’s Iron Law of Wages. When the French socialist economist, Thomas Piketty, resurrected the Iron Law of Wages in his own work in 2013, he found a ready audience for his ideas among American progressives.

The limited picture of private business possessed by progressives portrays companies primarily as conduits of wealth to the very rich. The companies create almost all of the wealth produced every year. According to the Left, they then pass on most of that new wealth to the fabled 1% in the form of increased stock valuations and dividends.

In the view of the Left, private businesses are at best a necessary evil. Therefore, government must strictly regulate their behavior. Since the regime of the progressive President Woodrow Wilson (1913-1921), the federal government increasingly has been accreting economic power over American companies. Every now and then, a Republican administration would slow this accumulation of federal economic power, but the accumulation was almost never significantly reversed. No better example of this accretion can be found than the progressive response to the Great Recession.

The proximate cause of the Great Recession of 2008-2009 was a bank financial crisis in 2007-2008. This crisis was brought about by a bursting real estate bubble, popped by foreclosures on a great many “subprime mortgages.” In any such disaster, progressives will automatically look to free-market failures as an explanation. Since the subprime mortgages, sold to predominately poor people, were originated by banks and other investors, Democratic politicians immediately pointed to them as the villains.

Democrats accused them of creating subprime mortgages for poor people who could not afford them. Yet, the creation of these mortgages was in fact mandated by the federal government. In the early part of the first Clinton administration (during which the Democratic Party controlled both houses of Congress), the Community Redevelopment Act of 1977 was amended to mandate that Fannie Mae and Freddie Mac ensure that at least 30% of mortgages purchased from originating banks be made to people at or below the median income level in their communities. This goal was subsequently increased to 56% by the department of Housing and Urban Development (See reference [E4, chapter 1]). The completely laudable goal of providing home ownership for the poor led the federal government to create the worst financial disaster since the Great Depression.

The George W. Bush administration even saw the catastrophe coming and begged Congress to stop Fannie Mae and Freddie Mac from requiring banks to make subprime mortgages. The response from the Democrats was ridicule, as shown in a Fox News report shown below. Without the support of the Democrats, legislation could not be passed to eliminate the threat.

The Democratic response to the Great Recession at the beginning of Obama’s first administration was the Dodd-Frank Act, which has been very destructive to the financial industry, particularly to community banks. The progressives took the excuse of the Great Recession as a reason to forge even more governmental chains for private financial institutions.

Beginning sometime in the late 1960s, after many decades of increasing government power over our not-so-free-market, the chickens finally started coming home to roost. If you average GDP growth rates over the business cycle, what you will obtain is the long-term secular growth rate. This is done below for the U.S. per capita GDP between 1965 and 2016.

Data Source: The World Bank

In fact, declining secular growth rates seem to be a problem observed throughout the Western world, as I discussed in The Economic Decay of the West. The one illuminating exception is the Republic of Ireland.

It seems there is something about corporate roles in Western society that dirigistes — including American progressives — do not quite understand.

Why the Progressive Views Are Wrong

When an American progressive looks at a corporation, all he or she can see is a producer of wealth and a conduit of that wealth to the oppressing super rich. That channeling of wealth results from the fact the rich own stock in the wealth producing companies. The wealth of the rich can then increase for one of two reasons: either through dividend payouts or through increases in stock market valuations. Dividend payouts are generally very small fractions of the annual corporate earnings after taxes. They are rarely more than a few percent of a company’s after-tax earnings. Most of those earnings are used for other purposes. Dividends are not the primary way in which the rich grow richer.

What really makes the rich richer are the increases in the values of the stocks they own. This is what Thomas Piketty pointed toward, when he tried to resurrect the Iron Law of Wages. However, increased stock valuations are not guaranteed. Investors might make errors in judgement causing them to invest in companies that lose income rather than grow. When this happens, the stock market takes money away from the foolish investors, and bestows it on investors wise enough to allocate their assets on companies with growing earnings. The super rich can remain the super rich only so long as they continue to discover the best companies in which to invest their capital.

What progressives would have us believe is that this mechanism is not for the benefit of society. Why should the super rich spend all this money, when it could be taxed away from them and redistributed to the less fortunate? The problem with this attitude is it does not recognize the great service the rich give to society, when they do their very best to direct capital towards the greatest needs of the economy. When they are successful, the rich are given even more assets to allocate for society through the increased value of their stocks. When they are unsuccessful, some of the assets they had are taken away from them, and given to more successful investors.

It is not as if the super rich consume all their huge investment incomes for their own personal benefits. While their investment income (including increased stock valuations) might be in the billions of dollars, their actual consumption is more likely to be in the millions, or rarely at the very most the low hundreds of millions of dollars. It is just not physically possible to consume more. The vast remainder of their income must be used elsewhere. The remaining choices for the surplus income of the very rich are rather limited. They can either give to charitable causes, or they can reinvest in projects they think useful for the economy. Either way is for the benefit of society.

Those progressives who tout the virtues of socialism in allocating economic resources ignore one vitally important, historically confirmed fact: Governments are simply incapable of wisely making such allocations. No country with a socialist economy has ever been able to solve the economic calculation problem. This is the problem, first proposed by the Austrian economist Ludwig von Mises in 1920, of finding the optimal allocation of scarce economic resources to maximize growth and meet the needs of the economy. The free-market solution of the problem comes automatically from the price mechanism, i.e. from the joint action of the laws of supply and demand and of marginal utility. The universally accepted metaphor for this free-market price mechanism is Adam Smith’s Invisible Hand.

Some of the historical evidence for government incompetence in solving the economic calculation problem is offered in the following posts:

- Historical Lessons on Economics and Politics

- More Historical Lessons From Europe

- Lessons From The Developing World

- The Economic Decay of the West

- The Great Irish Economic Experiment with Capitalism

- Comparing the Economies of All Countries on Earth

The reason why government has never been able to solve the problem is quite easy to find: All large social systems of interacting human beings (economies, political parties, governments, corporations, etc.) are chaotic systems. This means small perturbations on the system can grow and propagate throughout the system in unpredictable ways. In fact, large social systems are chaotic for exactly the same reasons that the planetary atmosphere is a chaotic system. They are composed of a large number of components (human beings), each one of which has a large number of degrees of freedom. These degrees of freedom are the choices they can make in what and how much to consume, political preferences, and a multitude of other preferences. The molecules in the atmosphere actually have far fewer degrees of freedom. These are primarily the six provided by each molecule’s three components of position and three components of velocity. Moreover, human beings constantly interact with each other, either individually or with other social groupings (merchants, banks, political parties, etc.). These interactions are analogous to collisions between air molecules, which tend to change their degrees of freedom in often unpredictable ways.

So, why does Adam Smith’s Invisible Hand solve the economic calculation problem so much better than governments? It is because the law of supply and demand and the law of marginal utility operate at the level of individual interacting human beings. An actual stable equilibrium is never achievable, but slowly changing quasi-static equilibria are. By allowing everyone to satisfy their needs as best they can consistent with the needs of everyone else, Adam Smith’s Invisible Hand allows quasi-static equilibria to form. Governments do not have anywhere near enough data to direct the economy’s resources to accomplish this, even if they wanted to do it.

The problem with progressives and other dirigistes is they do not believe social reality limits government in this fashion.

The Social Roles Performed by Companies of All Sizes

We are now in a position to describe what progressives do not understand or appreciate about the social roles of private companies.

First, the political Left does not understand how destructive government interference with the economy truly is. While they understand companies create almost all the wealth, they generally believe government would do just as well, if not better, in allocating resources. The reason they are wrong in this judgement is that companies make decisions based only on their own economic well-being. Politicians, on the other hand, often make economic decisions for other than economic reasons. Also, since government officials tend to make decisions affecting many companies, they are bound to make decisions harmful to at least some businesses. Corporate managers are laser-focussed on their own particular niche of the economy. Being influenced by Adam Smith’s Invisible Hand, companies are in a much better position to allocate resources in a way that does not damage supply-demand balances.

In addition, companies provide the primary means by which new wealth is channeled to the population at large. Wages supported by the economic output of jobs are sustainable; income from welfare programs absent the output of companies is not. Furthermore, companies help people save for retirement through 401(k) accounts. Through these accounts or Individual Retirement Accounts (IRAs), ordinary people can share in the wealth represented by corporate stock valuations. The super rich are not the only ones who can benefit from stock ownership. These are facts progressives seem to forget when they advocate polices hostile to corporate profit-seeking. Where do progressives think most people get their jobs, incomes, and retirement savings?

Views: 3,485

Charles, I think that large corporations are responsible for how long it took to recover from the 2008 recession. The S&P profit margins are 50% higher than historical averages, yet the companies have not, until very recently, been investing this money in new machinery, etc, but instead have been buying back stocks or increasing dividends. This process amounts to a sales tax that transfers money from consumers to savers, where it tends not to support consumption. What would be best is if these excess profits were returned to the consumers in the form of lower prices. Then consumers would have… Read more »

I think you are quite right to point to low corporate investments during the Obama era and before for our economic stagnation in recent decades. However, I think you are very wrong in blaming the companies themselves for this behavior. Instead, I think the observable historical evidence implicates government policies, particularly economic regulations. High taxes, which made American corporations uncompetitive with foreign companies even in our domestic markets, also played a large role. I reviewed some of the evidence concerning government regulations in this post, as well as in a number of others. A reasonable summary of the problem together… Read more »

Charles,

I did not say that corporate profits are too low, I said that they are too high and have been even under Obama. During the Great Recession, companies laid off their least productive workers and worked the remaining extra hard, producing the excess profits even in the face of the recession. The companies should have reduced prices so consumption would have increased and ameliorated the recession. But since the S&P companies are oligopolies they didn’t face competition.

Jon, Rather than profits being high for corporations, U.S. companies actually suffered an earnings recession in the last two years of Obama’s administration. I showed the data for this in the post A Corporate Earnings Recession Continues. In that same post I showed graphs demonstrating the only reason stock values stayed afloat over that period was because of corporate stock buybacks. Because it was so difficult to earn a profit during Obama’s administration, companies did not do much productive investing in the U.S. Stock buybacks were just one thing they did with their free cash. They also paid out dividends… Read more »

WHAT A LOAD OF RIGHT WING BALONEY AND HORSE CRAP!!!! RIGHT WINGERS HAVE CONTROLLED THE USA FOR MOST OF THIS NATIONS HISTORY…. AND YET… ITS THE LIBERAL DEMOCRATS FAULT THAT REPUBLICANS HAVE SCREWED EVERYTHING UP???? DEMOCRATS HAVE NOT CONTROLLED THE USA SINCE THE MID 1960S… EVER SINCE ALL THE RIGHT WING SOUTHERN DEMOCRATS STARTED VOTING WITH… AND THEN JOINING… THE REPUBLICAN PARTY…. AND IT IS NO ACCIDENT THAT THE USA HAS GONE DOWN HILL EVER SINCE THEN, AS REPUBLICANS HAVE BECOME EVER MORE POWERFUL… AND EVER MORE EXTREMIST AND SELFISH AND GREEDY AND SELF CENTERED AND SELF RIGHTEOUS AND JUST… Read more »

You are answering my post with a series of assertions unsupported by empirical evidence. You say that right-wingers have controlled the U.S. for most of its history? In fact, since the mid-1960s, power has generally been split between the parties. In the periods when one party has controlled the executive branch, the other party has controlled at least one chamber of Congress. So, the big question becomes which party supports policies better supported by social reality? An assertion I often make is that the more government tries to control its society, the worse off that society generally becomes. How would… Read more »