The U.S. Federal Government Budget

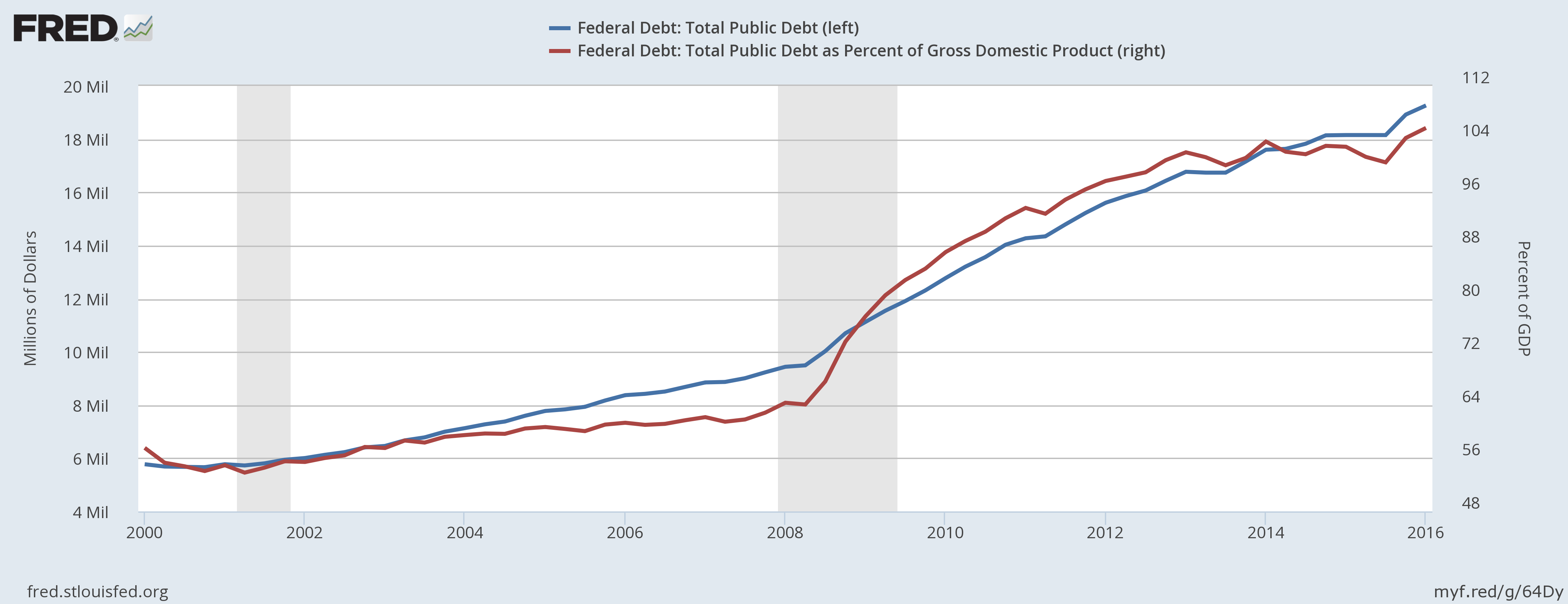

Total U.S. Federal Government Debt in millions of dollars (blue curve with scale on the left), and its share of GDP in percent (maroon curve with scale on the right).

St. Louis Federal Reserve District Bank/FRED

The total U.S. federal government debt is beginning to look very scary. It terrifies me, and it should at least frighten you! According to the Federal Reserve, the total federal government debt is $19.6 trillion, while the annual GDP is about $18.23 trillion. A quick exercise in arithmetic will reveal that the federal debt is approximately 105.7% of the entire annual economic output of the nation. While budget deficits have been held down since 2013 with sequestration authorized by the Budget Control Act of 2011, the Congressional Budget Office (CBO) has just informed us in their annual budget and economic outlook report that the budget deficit will again begin to rise this year – approximately 5 years early – after six years of decline. This was not supposed to happen until 2021 when sequestration was to end!

Why It’s a Problem

I have already written on why this is such an urgent problem in The Thoughts that Haunt Me, so I will only summarize the basic problem here. For the reasons I related in that post, the federal debt tends to grow exponentially. The federal debt as a percent of the GDP, the entire annual economic production of the United States, might dip or rise around an exponential trend curve due to recessions, political events, or high growth immediately following recovery from a recession. (At least there used to be high growth following a recession! This time around there was no such growth.) Nevertheless, because the federal government almost always spends more than its revenues, and because it almost always rolls over its debt by issuing more treasury bonds, the trend has always within my 70 year lifetime been exponential growth. The graph above shows the debt growth since the year 2000, but plotting the debt since 1980, as shown below, makes the exponential growth even more apparent.

Image Credit: St. Louis Federal Reserve District Bank/FRED

This is bad enough, but in addition we are running against a deadline. The Heritage Foundation has estimated that by 2035, less than two decades from now, if nothing is changed in federal expenditures, then entitlements (Social Security, Medicare, and Medicaid) will absorb around 34 percent of the GDP. Not of the federal budget, but of the GDP! We also know from Hauser’s Law that no matter what the tax rates, the federal revenues have always fluctuated in a narrow band between 15 percent and 20 percent of GDP with average around 19 percent. With debt growing exponentially, payment of interest on the national debt will also grow exponentially. Long before 2035 (probably sometime in the mid 2020s), expenditures for the entitlements and interest on the national debt will absorb every single penny of federal tax revenues. All other functions of our national government will then cease, as no other government functions can be financed. And mark this point well! Because of Hauser’s Law, absolutely no increase in taxes will be able to hold off this catastrophe.

Dissecting the Federal Budget

According to the Federal Reserve, the annualized first quarter 2016 current expenditures of the federal government were $4.10 trillion, which is 22.5 percent of the

St. Louis Federal Reserve District Bank/FRED

annualized $18.23 trillion GDP for the first quarter of 2016. Right now, expenditures are increasing at an annualized rate of 4.2 percent, which is approximately double our average GDP growth of the last eight years! Even ignoring the considerations from the previous section, this one fact all by itself would tell us we have an extremely urgent need to cut government expenditures.

So what do we have with which to work? A pie chart for the fiscal year 2015 budget, the last enacted budget, is shown below.

Image Credit: USBudgetAlert.com

Note that if we add up the entitlements of Social Security, Medicare, Medicaid, plus other mandated expenditures, ACA (Affordable Care Act) subsidies, and net interest on the national debt, we obtain 68 percent —a little over two-thirds — of the federal budget, The entire defense budget, which is discretionary spending, absorbs only 16 percent of federal spending. The remaining discretionary spending also takes in 16 percent.

What Must We Cut?

Not only is entitlement spending the largest hunk of the federal budget, it is also rapidly increasing with time, as you can see in the plots of mandatory and discretionary spending below.

Wikimedia Commons/Farcaster

There can be little doubt given all these facts. We must cut the largest and most rapidly growing part of the federal budget, the entitlements, or allow the federal government to spend itself out of existence. We can not tax our way out of the problem because of Hauser’s Law. We can not simply move assets from the discretionary part of the budget, which includes the defense budget, because that piece is much too small. Besides, I do not think you would like being conquered by ISIS, Russia, China, or Iran for lack of defense! If we wish to continue as an independent nation to choose our own way of life, we have no other choice but to cut the entitlements. I have offered a few ideas on how to do this in the post The Hard Work: Cutting Entitlements, and you can find additional discussion on this problem in the Heritage Foundation page Entitlement Reform.

What the Politicians Are Promising

Unfortunately, what the two major party presidential candidates have to say about this problem is extremely depressing. One has to believe either they are dissembling or they are extremely ignorant about the budget realities. Since I can not believe they are that ignorant, I am forced to think they are both dissembling to pander to the electorate. To the extent that progressives talk about the budget problem at all, they suggest either to transfer spending from the Defense Department to pay for entitlements, or to increase taxes as both Bernie Sanders and Hillary Clinton have proposed.

Donald Trump, on the other hand, has suggested at various times that either we could refuse to pay the national debt, forcing treasury bond holders to take huge hair-cuts, or that we could inflate the debt away by creating the money to pay the treasury bonds off. Beyond this pair of idiocies, Trump to his credit has suggested he would “cut spending big league”. However, other than cutting those perennial political favorites, “waste, fraud, and abuse”, he has pledged not to touch entitlement benefits.

What can those politicians possibly be thinking? In the Democratic Party they might possibly be considering that the crack-up of the federal budget could be an opportunity to nationalize large pieces of the economy, particularly the medical and pharmaceutical industries. Then, they could dictate wages and prices to make the federal budget fit. If this is their hope, then they have forgotten the end-history of the Soviet Union, or the more recent histories of Cuba, Venezuela, and Brazil.

As for Donald Trump, other than his refusal to touch the entitlements, he has a compelling story to tell about reducing taxes and economic regulations. With some of the more notable names from Ronald Reagan’s old economics team — Arthur Laffer, Larry Kudlow and Stephen Moore — advising Trump, we can at least hope the Donald will give an attentive ear to better advice.

Views: 5,091