The Phillips Curve in New Keynesian Economics

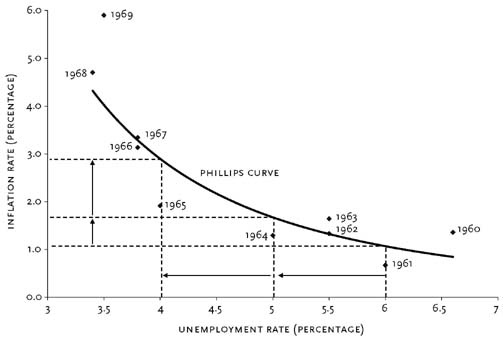

The original Phillips curve for the U.S. fit to 1960s data.

A non-economist might justifiably be confused about why the Federal Reserve, the European Central Bank (ECB), and the the Bank of Japan (BOJ) have insisted on keeping interest rates effectively at zero for almost an entire decade. After all, they have not had any good results in stimulating their economies. After a considerable period with no appreciable change in their low rates of economic growth, one would have to ask whether continually trying to do the same thing with no positive change was not defining central banks as insane.

The Original Phillips Curve

If you have such a confusion about central banks, you should consider what you would ask of a New Keynesian central banker in asking her/him to abandon easy money. The near religious faith Keynesians have in the efficacy of low interest rates to generate increased economic growth predates the New Keynesians. This faith originated with their predecessors, the Neo-Keynesians, with the development of the Phillips curve. Shown in the figure above, the Phillips curve was an inverse relationship between the unemployment rate and the inflation rate. If you wanted to have less unemployment, you could have it so long as you were willing to accept the implied increase in the inflation rate.

The Phillips curve was invented by William Phillips, a New Zealand economist, in 1958 using data on unemployment and rates of change of wages in the British economy between 1861 and 1957. Later in 1960 the American economists Paul Samuelson and Robert Solow

Image Credit: Wikimedia Commons/Eric Findlay

adapted Phillips’ work to U.S. data, and made the link between inflation and the unemployment rate explicit.

During the 1960s and 1970s the Federal Reserve used the curve developed by Samuelson and Solow, shown above in the post’s featured image, to adjust interest rates to obtain desired combinations of unemployment and inflation.

The Stagflation Crisis

In the latter half of the 1970s, however, it become clear from experiences with the oil supply shock of 1973 and the stagflation it created that something was terribly wrong with the Phillips curve model. Simultaneous high inflation and economic stagnation with consequent high unemployment was just not supposed to happen!

The explanation for the Phillips curve’s error was initially given by the monetarist Milton Friedman and independently by Edmund Phelps. They both argued that as workers and companies in a long-term inflationary environment became used to and expected inflation, workers would demand and companies would give additional wage increases to counteract the inflation. These additional wage increases on top of ordinary wage increases created even more inflation as the additional labor costs were passed on to the consumer. Eventually price increases would not be totally accepted by the consumers and demand for goods would decline to cause economic stagnation. In the latter half of the 1970s, the inflation initiated by the oil supply shock of 1973 but fueled by easy money policies of the Federal Reserve, grew into stagflation with inflation expectations causing inflationary wage increases.

The New Keynesian Reaction

The Neo-Keynesians took the criticisms of Friedman and Phelps into account and incorporated their ideas in a new neoclassical synthesis along with other New Classical ideas. The changes were major enough that those Neo-Keynesians who accepted the new synthesis became known as New Keynesians. The heart of the changes in the views of inflation by New Keynesians have been discussed in the posts New Keynesian Adjustments for Inflation and How New Keynesians Explain 1970s Stagflation.

However, the Phillips curve still has a place in New Keynesian theory. After all, there was all that data from the 1960s that fit a Phillips curve quite well, before the inflationary expectations of the 1970s spoiled the picture. To adapt the ideas of Friedman and Phelps to a new view of the Phillips curve, the New Keynesians included New Classical ideas about rational expectations and the Keynesian idea of the Non-Accelerating Inflation Rate of Unemployment (NAIRU). It was assumed that if the unemployment rate stayed below NAIRU for a few years, then inflation and inflationary expectations would rise. On the other hand, if the unemployment rate remained above NAIRU, inflationary expectations and inflation would fall. Should the unemployment rate be exactly equal to NAIRU, the inflation rate would tend to stay constant if there were no exogenous shocks.

If the economy had unemployment above or equal to NAIRU for a number of years, the New Keynesians believed a stable Phillips curve would exist, shown as the initial short-run Phillips Curve in the figure below. If the economy is at any

Image Credit: Wikimedia Commons/Asacarny at English Wikipedia

point on the NAIRU vertical line, then the inflation rate given by the point’s coordinate on the vertical axis (the point’s ordinate) would be a constant inflation rate for the economy, We will assume that the economy starts at point A right on the NAIRU line. If policy makers at the central bank then lower interest rates to stimulate the economy, the unemployment rate will go below NAIRU and move under the influence of the stimulus along the initial short-run Phillips curve to some point B at a higher rate of inflation. However, once the stimulus has run its course, rational inflationary expectations will then shift the entire short-run Phillips curve to the right and the economy will move from point B horizontally at constant inflation until the system’s constant inflation line intersects the new short-run Phillips curve at point C. Note that in this last step the unemployment rate increases until it hits NAIRU at the same inflation rate as point B. The end result of the stimulus is the economy ends up with higher inflation at exactly the same unemployment rate as before the stimulus. It does not pay to push unemployment below NAIRU!

However it became evident in the 1990s that NAIRU itself could change in unpredictable ways. During the 1990s unemployment fell below 4%, below almost all estimates of NAIRU. Yet inflation remained moderate. Since the dynamics determining changes in NAIRU are debatable, about the only thing that can be said is that as long as inflation is not accelerating, the unemployment rate must be above NAIRU. This may be the reason why the Fed instituted a policy of paying a small rate of interest on excess reserves, so that it could substantially recapture most of the money created through market operations and the purchase of long-term assets back into excess reserves. See What Has Happened to All That QE Money? and Quantitative Easing and Its Effects. In this way they could fine-tune the inflation rate by either adding to the money stock in general circulation by reducing interest paid on excess reserves, or they could decrease the amount of money in general circulation by increasing the interest rate. As long as inflation was not accelerating, the Fed was operating safely. Or so they thought.

The Results of Keynesian Monetary Policy

What the Federal Reserve has been counting on has been that as long as inflationary expectations do not increase, then the economy must be on a stable Phillips curve. They can then push interest rates down as low as is possible to increase inflation to decrease unemployment, as long as the increased inflation rate does not accelerate. I suspect the Fed did not believe that their power to increase inflation and therefore (in their view) to increase the economic growth rate was close to non-existent. Yet that is precisely what happened. This was due primarily to the falling velocity of money. You can increase the quantity of money as much as you like, but if the the product of the quantity of money with its velocity does not increase, neither inflation not the GDP growth rate will increase.

So why is this happening? Why are corporations not borrowing all this free money at zero real interest rates and spending it on increasing the country’s and their own productive capacity? As anyone who has been halfway paying attention could tell you, it is because they have ben borrowing all that free money to buy back their own stock and to pay dividends. Also, because of increased scrutiny on banks’ loans because of Dodd-Frank Act regulations, banks are very reluctant to lend to any person or company that does not have an outstanding credit rating. Blame the government, not the banks for this. The Federal Reserve could offer all the free money in the world to companies to make investments, but if the executive branch of government, with the collusion of previous Democratic Congresses, kicks the free market in the gut every chance it gets, one can not be surprised if companies are very reluctant to invest. For more on this, see The Burden of Economic Regulations, The Debilitating Effects of Obamacare, Economic Effects of the Dodd-Frank Act, The EPA, CO2, Mercury Emissions, and “Green” Energy, and Economic Effects of Current Tax Policy. In fact, the federal government has grown so hostile and onerous a burden to corporations, that many are lining up to flee the country.

Even worse, all the while monetary policy was failing to stimulate the economy, the policy was actively damaging it by inflating asset bubbles and destroying incentives to save. Total national savings is the ultimate source of future investments.

The most basic problem the Fed is facing is monetary policy is not an appropriate tool to encourage economic growth directly. No matter how trustworthy the Phillips curve is at any one time, it is the reduction of government power over the economy that will pay dividends.

Views: 4,933