The Ideological Balkanization of the United States

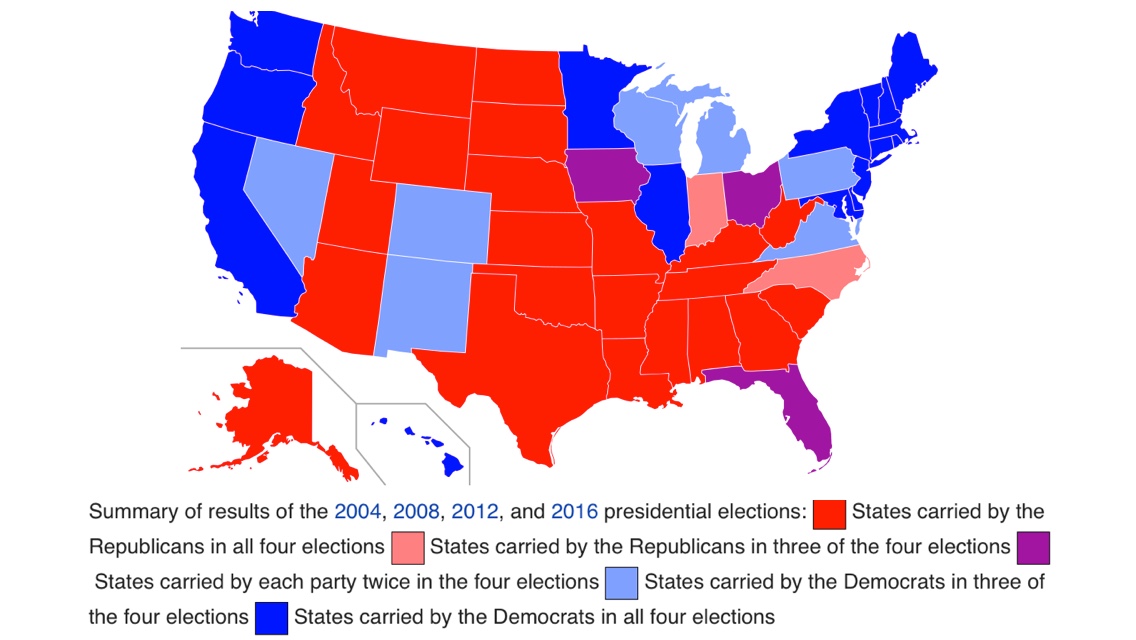

The red state – blue state division of the United States as revealed by the presidential results of the past four presidential elections.

Wikimedia Commons / Angr

This week The Sacramento Bee reported additional evidence for the ideological balkanization of the United States. The newspaper of California’s capitol reported the state government is now banning publicly funded travel to four more states because the California government views those states’ laws or policies as discriminatory to gay and transgender people. The four new states on the list are Texas, Alabama, Kentucky, and South Dakota, all of which are red states according to the map above, i.e. Republican and neoliberal (aka “conservative”). Those four new states join Kansas, Mississippi, North Carolina, and Tennessee, similarly red states. As of now, I am unaware of any similar bans by red states against blue, i.e. predominantly Democratic and progressive states.

The Blue State – Red State Model

In recent decades the American states have been separating into two competing neoliberal and progressive camps. The blue or progressive states are predominantly those comprising the Northeast, the West Coast, Illinois, Minnesota, and until the last presidential election, Michigan and Ohio. The red states are most of all the rest.

The blue states, being controlled by believers in the goodness of government, emphasize policies with:

- High levels of government spending,

- High income taxes on “the rich”,

- Generous welfare programs,

- Heavy regulation of companies,

- Requirements for union membership to work in unionized labor markets,

- Minimum wage laws,

- And oftentimes with restrictions on the production and use of fossil fuels.

In contradistinction, the red states are predominantly controlled by people who want to limit government to a minimalist level. These are people who believe government policies are frequently counterproductive. As a result, if you were to take each of the progressive state attributes in the bulleted list above and negated it, you would get the corresponding attribute for the red states. While contemplating this dichotomy, I am reminded of Abraham Lincoln’s observations on the foremost issue of his day in his “House Divided” speech.

“A house divided against itself cannot stand.” I believe this government cannot endure, permanently half slave and half free. I do not expect the Union to be dissolved — I do not expect the house to fall — but I do expect it will cease to be divided. It will become all one thing or all the other.

Animosities Between the States

Travel bans are not the only indications of ideological stress between the blue and red states. However, it is more usually the red states irritating the hell out of the blue states with their policies. For example, at the same time blue states have raised their top marginal income tax rates, red states have been reducing them. In ten of the blue states, the combined state and local top income tax rates exceed 10 percent (12.9% in New York, 11.3% in Hawaii, 10.8% in Vermont, 10.7% in Maine, 10.2% in Minnesota, 10.2 percent in Connecticut, 10.1 percent in New Jersey, 10.1% in Rhode Island, 10% in Illinois, and 13.3% in California). In these blue states, their rates when combined with a top marginal federal income tax rate of 39.6% means that without tax deductions the top combined rates are in excess of 50%! Meanwhile, red states like Arizona, Arkansas, Kansas, Missouri, North Carolina, Oklahoma, and Idaho have been busy cutting their tax rates. The differential between blue and red states provides a big disincentive for wealthier people to live in the blue states.

Unlike the blue states, the red states are also making themselves attractive to relocating companies through right-to-work laws. These laws do not prohibit unions, but they do free workers from the requirement to join a union. When coupled with lower taxes and less onerous business regulation, these enticements are drawing an increasing exodus of people from the blue to red states. This exodus will be discussed and quantified in the next section.

Finally, if Trump and the GOP have their way with tax reform, the progressive blue states will almost certainly have an additional grievance against the red. One of the tax reforms being discussed is an elimination of deductions for state and local taxes. Not only would the elimination of these deductions help finance tax cuts, they would also end a federal subsidy for the progressive programs of the blue states. No longer would the taxpayers of red states be obliged to subsidize those programs.

People Voting With Their Feet: Red States Getting Richer and Blue States Getting Poorer

In April of last year I wrote a post entitled Where Leftists Take Over, People Vote With Their Feet. In it the phenomenon of people fleeing their countries from the tyranny of leftist rule was discussed. Not only do leftist governments destroy the freedom of individuals to direct the bulk of their

Wikimedia Commons / PH2 Phil Eggman, U.S. Navy

own lives, they also inevitably greatly curtail economic opportunity for most of their population, a subject discussed in the posts Historical Lessons on Economics and Politics and Lessons From The Developing World.

The same sort of reaction can be seen in the flow of people and businesses out of the blue states and into the red. The U.S. migrations might not be as startling and gripping as that of the Vietnamese boat people risking their lives in small boats on the open sea, but they have the same prime mover: Authoritarian state government becoming a parasite on the body politic. People will naturally migrate to where they can build better lives for themselves and their families.

Where is the evidence for this migration between blue and red states and for its causes? For this I turn to a Heritage Foundation post, 1,000 People a Day: Why Red States Are Getting Richer and Blue States Poorer written by Joel Griffith, a research associate in the Institute for Economic Freedom and Opportunity at The Heritage Foundation. The post excised data from a more complete report of the same title by Stephen Moore, Arthur Laffer, and Joel Griffith, which you can download here. The data presented is accumulated over multiple years or averaged over approximately a decade between 2003-2013. It can not be presented on an annual basis because it takes time often stretching over many years for populations and businesses to respond to changes in state government policies.

First, their evidence for the exodus from blue to red states is provided by the chart below. It provides the cumulative net (inflow minus outflow) domestic migration for the ten states with the largest out-migrations and the ten states with the largest in-migrations.

Heritage Foundation / Laffer, Moore & Williams

Going down the list of states with the largest out-migration, you can see that with the exception of Louisiana, a red state, they are all blue states (although Michigan and Ohio may be in the process of changing sides). Going down the list for the states with the largest in-migration, you can see they are all red states with the exceptions of the swing states of Florida, Nevada, and Colorado, and the blue state Washington. Florida is something of a special case because, although they have been captured twice each by the Democrats and Republicans in the last four presidential elections, their policies are predominantly neoliberal. For example, Florida has no state income tax and has encouraged school vouchers.

The effects of state income taxes are measured in the next chart, which shows in-migration for nine states with no income taxes and nine states with the highest income taxes. The in-migration was measured as a percentage of their population averaged over the decade between 2003 and 2013. Also shown is the percent change in their non-farm payroll employment averaged over the same decade.

Heritage Foundation / Laffer, Moore, & Williams

Clearly, the states with no income taxes greatly outperformed the states with high income taxes in attracting people and in creating new jobs.

Finally, the Heritage Foundation study compares the overall ten-year economic performance between the two groups of states. The table below gives the average percent changes in important economic statistics averaged over the decade 2003-2013, with the exception of the percent change in state and local tax revenues, which was averaged over 2001-2011.

Heritage Foundation / Laffer, Moore & Williams

Again, the states with no income taxes clearly out-performed on average those states with the highest income taxes. No-income-tax states increased their non-farm employment by 9.9 percent, while the high-income-tax states increased only 4.3 percent. No-income-tax states increased their average personal income 57.5 percent; high-income-tax states only 47.8 percent. No-income-tax states increased gross state product an average of 61.9 percent; high-income-tax states only 47.0 percent. Most intriguingly, the no-income-tax states increased their state and local tax revenues much faster than did the high-income-tax states, 82.0 percent on average versus 56.5 percent. It seems that if you want to maximize your tax revenues, it is much better to have lower taxes and higher economic growth than higher rates with lower growth.

I should note that although almost every state in the no-income-tax list is a red state, and almost every one in the high-income-tax list is a blue state, there is one exception in each list. Washington is definitely a blue state, and Kentucky is usually considered a red state. Florida, as noted above, generally has red state policies even though it has been a swing state in presidential politics.

One extremely important question raised by the Heritage Foundation study is the following: If economic development is going so much better in red states than blue states, then why are blue states generally richer with higher per capita and median family incomes? They declare,

The answer is that blue states were not always as dysfunctional in their policies as they are now. New Jersey was one of the five richest states in the nation in 1960 (and still is). It had neither an income tax, nor a sales tax. Now it has nearly the highest income and sales taxes in the nation, and it cannot balance its budget. It is a rapidly declining state. Connecticut had no income tax until 1992. Since then Connecticut has suffered flight from almost all of its cities.

The per capita income measure of how a state is performing is routinely cited as evidence that blue states are not falling behind, but this does not tell the whole story because population grows rapidly in high-growth states. Incomes rise, but so does the denominator population. Meanwhile, Rhode Island has suffered a population loss year after year, yet is still a very high per capita income state. If trends continue the state will only have a few people left, but they will likely have a high per capita income. When per capita income rises due to young people leaving or the birth rate dropping, it is foolish to conclude the state is better off.

What Will The Future Bring?

All of the preceding suggests blue states decaying as red states grow and prosper. As population and economic assets hemorrhage from the blue states and are picked up by the red, both economic and political power will transfer from states driven by progressive policies to those dominated by neoliberal policies. As population is lost in the blue states and gained by the red, electoral votes and votes in the House of Representatives will inevitably follow.

Views: 2,825