The Hard Work: Cutting Entitlements

FDR quote on Social Security Image Credit: Flickr.com/Donkey Hotey

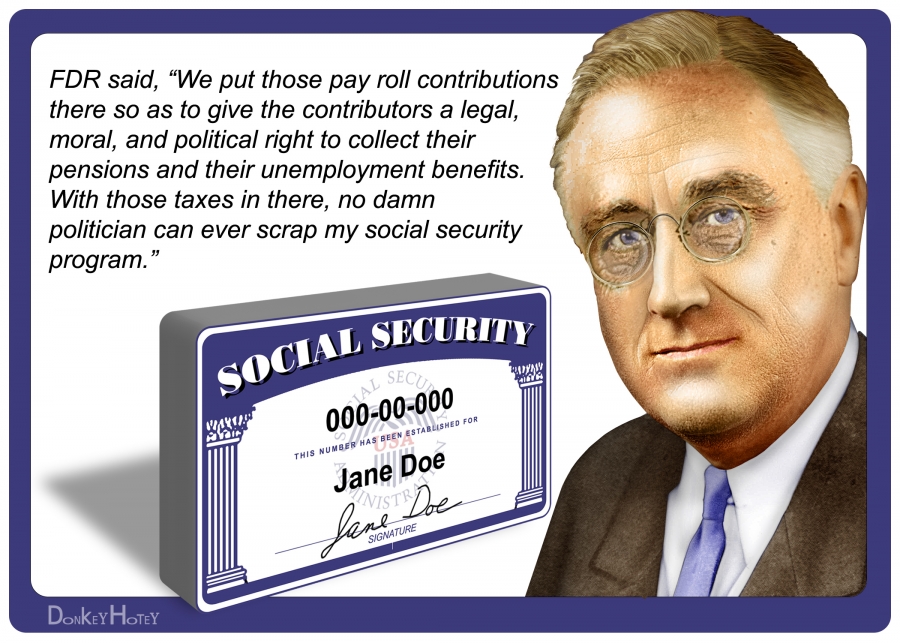

The hardest political job in cutting federal spending – and the most necessary – will be cutting the entitlements: Social Security, Medicare, and Medicaid. Most people in the United States probably believe Franklin Delano Roosevelt’s quote in the featured image above. After all, the government taxes every single pay check they receive for their Social Security and Medicare benefits when they retire. They have paid for their entitlements under these programs for their entire lives! Since they have paid into the programs, the assets must be there to finance their retirement, right? Wrong!

How Social Security Works and the Basic Problem of Deficit Spending

In fact, the nation has been betrayed by the squandering of those assets by politicians to finance other government programs. The way this Ponzi scheme works is as follows. The U.S. Treasury Department takes in the Social Security payroll taxes and subtracts from that amount the current payouts to Social Security recipients. If anything is left over, the balance is used to purchase very special Treasury bonds that are essentially IOUs of the federal government to the Social Security Trust Fund. These special-issue bonds are not negotiable instruments that can be bought or sold on the open market like other bonds, but are merely accounting entities used to keep track of the net income to the federal government from the payroll taxes. The tax receipts used to buy the special-issue bonds go into the government’s general fund to be spent on other government programs.

Supposedly, the special-issue bonds show how much the government is obligated to pay out from the general fund to Social Security recipients, but these payouts are contingent on the government receiving enough tax receipts to satisfy all claims. With the number of retired citizens growing faster than the number of younger workers who support the Social Security system, Social Security has become a Ponzi scheme. As the payouts to recipients begins to exceed the payroll taxes, the federal government will be obligated to make up the difference from its general fund. Once total current government obligations, including paying interest on the national debt, exceeds all tax receipts plus bond sales, the entire system will begin to collapse, ultimately leaving Social Security recipients with nothing. This is likely to happen within one to two decades.

The basic problem, not just for Social Security but for all other government obligations as well, is that the federal government habitually spends a lot more than it receives in revenues. Eventually, when government obligations become a lot larger than its income, bond investors will begin to question the federal government’s capability to repay its obligations from its taxes. At that point it will be very hard for the government to find investors willing to buy Treasury bonds to finance deficit spending, and some government programs, including Social Security, will be forced to shrink. Does this not sound like Greece for the past several years?

The Beginning of the End for U.S. Government Deficit Spending?

As I wrote in Will the U.S. Have Troubles Soon Financing Its Debt?, this problem of financing government deficits may already be beginning. From the year 2000 until roughly 2014, other countries – especially China, Japan, Saudi Arabia, and Switzerland – helped fill the gaping hole in national savings produced as a result of U.S. government deficit spending by buying U.S. Treasury bonds. Now, however, there appears to be yet another global economic crisis brewing, ready to boil over. The leading causes of this crisis appear to be a Chinese economic implosion (also read here and here and here and here), the failure of the European economy to relaunch, and a softening U.S. economy perhaps sliding toward recession. As a result countries around the world have a sudden need for capital to address their own problems, and they are dumping U.S. treasuries into the international markets at the fastest rate in 15 years. Consider the following chart from The biggest American debt selloff in 15 years.

Image Credit: CNN Money/US Treasury Department

With new needs for capital, foreign investors would not seem to be in a position to buy any more U.S. debt anytime in the near future. If that is true, who is going to pick up any new U.S. government debt put on the market? In addition the sudden new supply of long-term U.S treasuries from dumping on the international market lowers their price, driving up their yield. This means the U.S. government would have to pay higher interest rates to entice anyone to buy its bonds. Also, if the Federal Reserve does anything to increase long-term interest rates, the problems of government financing of deficits become even harder.

What Is to Become of Entitlement Programs?

In an international and national economic environment where supporting government debts will become progressively harder, the entitlement programs will also become increasingly difficult to maintain. In a sense Social Security recipients find themselves in the same place as bond holders of insolvent companies everywhere. Since most of the government obligations to Social Security recipients are special-issue treasury bonds, that is precisely what the recipients are! In the private sector if a company goes bankrupt, bond holders are the first claimants on the company’s wealth; but depending on how much the company is worth, the bond holders do not necessarily get their original investments back. Instead, the presiding judge in the bankruptcy hearing may order only a partial repayment of bond principal. The farther the United State goes toward insolvency before entitlements are addressed, the more likely a solution like this must be used with large decreases in monthly Social Security payments made, with zero being the lower limit.

Some suggestions for the cutting of entitlement spending are shown below.

- One simple way of reducing entitlement spending for Social Security and Medicare would be to progressively increase the eligibility age to match increases in longevity. The higher the eligibility age, the more expenditures would be reduced.

- Another suggestion for Social Security and Medicare is to employ “means testing” of recipients. Upper-income citizens could be given reduced or eliminated benefits. However, since citizens of greater wealth are fewer than those of lessor wealth, however you define the limits, it is problematical how much in savings could be really achieved.

- Another interesting suggestion for Social Security is to give citizens a choice of whether they would prefer a traditional Social Security account, or whether they would like to have their payroll taxes go to a 401K-like program. For safety, the Congress could require a 401K-like program to invest in investment-grade bonds. Alternatively, all Social Security accounts could be in a 401K-like program. This would have the virtue that individual citizens would own their accounts, not the government; and Congress could not use Social Security as their private piggy-bank for funding their pet legislative programs.

One way or another, entitlement payments will be reduced. That is a fact. Older people either retired or on the verge of retirement can scream all they want about the injustice of not getting benefits, but if payments are not reduced the system simply can not be financially supported. Since I myself am a Social Security recipient, I understand the pain of regarding reduced or eliminated benefits. Nevertheless, reality is not to be ignored, and the sooner we as a nation realistically deal with this problem, the less painful it will be. If we wait a decade, it can be very, very painful.

Views: 2,849