The Fed is Losing Credibility (Duh!)

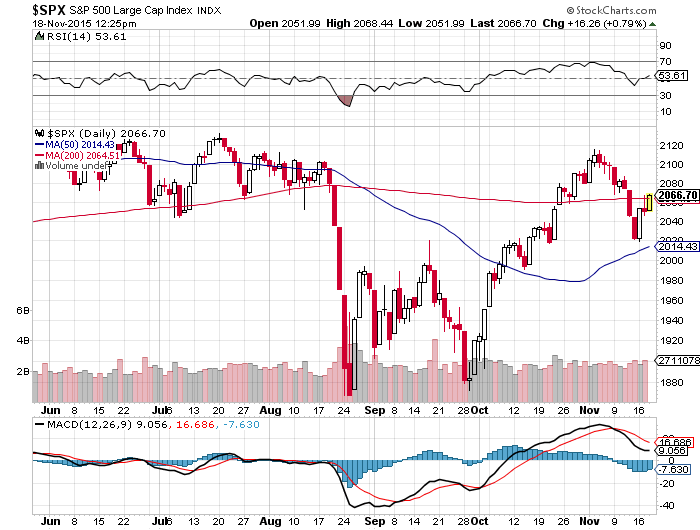

S & P 500 Index as of 11/18/15. Image courtesy of StockCharts.com

Two posts ago in The Wall Street Casino Is Open Courtesy of the Fed, I put forward the idea, growing increasingly popular, that the U.S. stock markets are totally divorced from economic reality. Instead, they and the Federal Reserve have been trapped in a positive feedback loop. Attempting to generate a “wealth effect” from a growing stock market, the Fed would keep both short and long-term real interest rates as close to zero as it could. Then either one of two things would happen later. Either the stock market would notice stocks were somewhat over-valued relative to what was happening in the economy, or (as was usually the case in recent years) the markets became very nervous that the Fed was about to make money less available by stopping Quantitative Easing (QE) or by increasing short-term interest rates. The stock markets would then begin a sell-off and the major indices like the Dow Jones 30 Industrials or the S&P 500 would start to fall. Fearing they were losing their precious wealth effect, the Fed would relent on any telegraphed ambitions for raising interest rates, and make clear to the markets their resolve to maintain zero real interest rates.

The markets would then reciprocate by driving stock prices ever higher. This process would continue until the next time markets doubted the Fed’s resolve to keep real interest rates at zero, at which time the Fed would have to publicly reassure them to keep the wealth effect going. Sometimes, if one of the QE phases (QE1, QE2, etc.) had ended earlier, this would require the initiation of a new phase of QE. You should recall how this created the mechanism for increasing stock valuations. Being able to borrow essentially free money, stock investors (read stock funds and corporations buying back their own stock) would borrow money to buy stock, thereby driving their values upwards. As stock values went up, investors could sell some to pay back their loans.

There have certainly been some who (at least publicly) have doubted this mechanism. As an example, see the post Four Simple Reasons An Epic Rally Is Ahead for Stocks by Bryan Rich. Also read my post What Do Others Think About the Economy for reasons I think each of Mr. Rich’s points are very, very wrong. For those doubters who are still dubious of the picture I painted above, I would like to cite a Zero Hedge post, The Fed Has Set the Stage For a Stock Market Crash. Graham Summers, Chief Market Strategist of Phoenix Capital Research, begins his essay as follows.

The Fed has created a very dangerous situation.

Ever since 2009, anytime the markets came close to breaking down, “someone” (read: the FED) has stepped in a[nd] propped the markets up.

Mr. Summers then proceeds, beginning with events in 2010, to document how the Fed has stepped in each time the stock markets began to pull back. The cause and effect chain are undeniable. My question now is, how much longer can stock valuations remain at these stratospheric levels (Shiller CAPE now having a value of 26.4) before they crash to more reasonable levels?

Views: 21,134