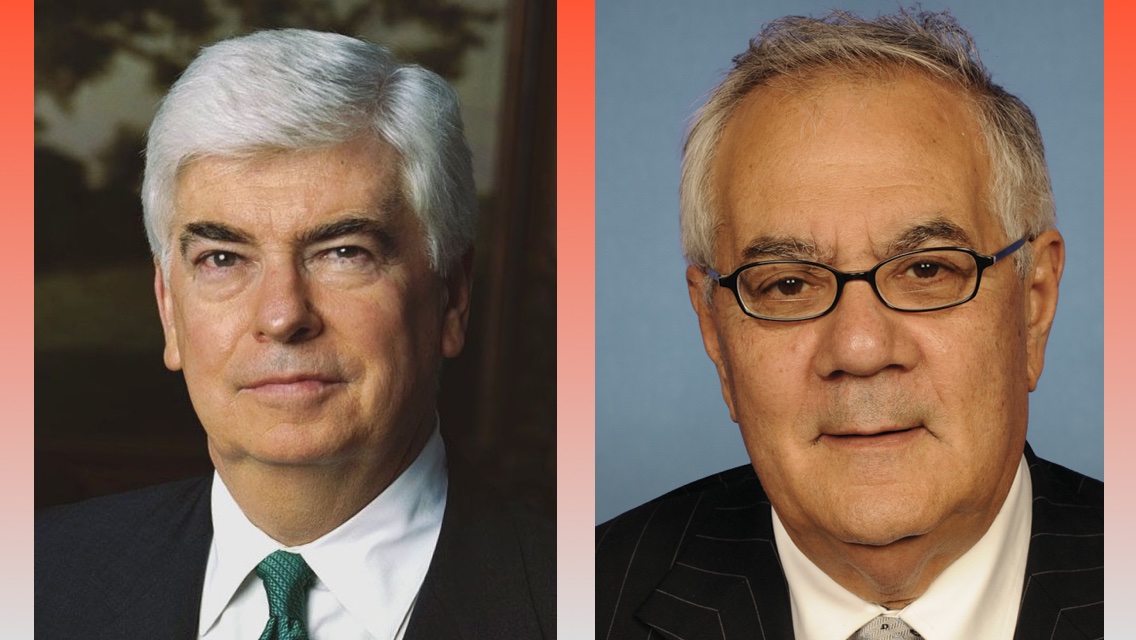

The Dodd-Frank Act: A Giant Stride Along the Road To Serfdom

Sen. Chris Dodd (D-CT) and Rep. Barney Frank (D-MA)

Wikimedia Commons / United States Congress, Wikimedia Commons / United States Congress

In my last post, I wrote of how federal government agencies and departments that administered executive branch promulgated regulations were pushing us toward an authoritarian state. In that post I described the Justice Department’s Operation Choke Hold, where Justice was attempting to greatly discourage and if possible destroy businesses, many of which were otherwise legal, of which they disapproved. What made this possible was the vast delegation of authority the Congress has given to the executive branch to enforce provisions of various legislative acts.

Unfortunately, Operation Choke Hold is not just a rare, aberrant case. There are many other examples. In this essay I will describe another case study where the Congress has delegated arbitrary powers to the executive branch: the Dodd-Frank Act.

The Origins of the Dodd-Frank Act

When I last wrote about Dodd-Frank in the post Economic Effects of the Dodd-Frank Act, I noted it was a solution to a problem that does not exist and therefore is unnecessary. The nonexistent problem was the rapacious greed of banks, particularly the investment banks of Wall Street, and other investors as a cause of the 2007-2008 financial crisis. I say that it is a nonexistent problem because investors and banks were not the cause of the financial crisis; the federal government was.

The financial cause of the crisis and the Great Recession that followed it was the bursting of a real-estate bubble, where many people of modest economic means defaulted on sub-prime mortgages. Sub-prime mortgages are home loans granted to individuals with poor credit ratings who otherwise would not qualify for conventional mortgages. Because of their greater risk, banks originating the mortgages generally charge higher interest rates for them.

So what would motivate the banks to practice such highly risky behavior? In fact at the beginning of the 1990s almost no banks gave out sub-prime mortgages, but by the end of 1990s most banks were creating them.

In February 2006, the Federal Reserve Bank of St. Louis published a paper entitled The Evolution of the Subprime Mortgage Market by Souphala Chomsisengphet and Anthony Pennington-Cross(SC&APC). If you dig deeply enough into the paper, you will see that very few institutions offered subprime loans in 1990, but by the end of the 1990s, most banks were creating such mortgages. In fact SC&APC state on page 36 of their report:

It was not until the mid- to late 1990s that the strong growth of the subprime mortgage market gained national attention.

So what happened between 1990 and the end of the ’90s that caused the formation of subprime mortgages to bloom? Was capitalist greed suddenly switched on during that time period, or was something else at fault? That something else turns out to be exceedingly easy to find. You can find it exhaustively documented in references [E3] and [E4].

In the early part of the first Clinton administration (during which the Democratic Party controlled both houses of Congress), the Community Redevelopment Act of 1977 was amended to mandate that Fannie Mae and Freddie Mac ensure that at least 30% of mortgages purchased from originating banks be made to people at or below the median income level in their communities. This goal was subsequently increased to 56% by the department of Housing and Urban Development (See reference [E4, chapter 1]). Then, when banks were hesitant to make such subprime mortgages, congressional committees called in bank CEOs to threaten them into making the mortgages. The threat was that Congress would mandate regulations to ensure that banks would make the desired subprime mortgages. Once the banks discovered they could quickly get rid of these mortgages, bundled into mortgage backed securities, by selling them to Fannie Mae or Freddie Mac, the die was cast. Nevertheless, when the crisis was started by defaults on the subprime mortgages, the big banks were still caught with a large number of these mortgages on their books, threatening their existence.

Of coarse, none of this could have happened if the Federal Reserve did not create enough money for the banks to use for loans. Without this new money, the banks could never have inflated the real-estate bubble. The Federal Reserve, the Congress, and the Clinton administration all have dirty hands in the Great Recession’s creation. Private banks did indeed originate almost all of the sub-prime loans, but it was fear of what the federal government could do to them if they did not follow orders that drove them, rather than merely greed. In fact, greed would motivate bankers to never give out sub-prime mortgages to avoid the loses. That was the way they behaved prior to the Clinton administration. The banks did what the federal government required of them.

Following the Clinton regime, the George W. Bush administration could see the coming crisis, and vigorously tried to get Congress to withdraw the legal requirements for sub-prime mortgages. Consider the evidence of the video below. Note especially Barney Frank’s reaction to the Bush administration warnings.

The next video explains the Federal Reserve’s share of the culpability.

Democratic politicians desperately needed to redirect the blame away from themselves. This led them to point the finger at the originators of the sub-prime mortgages, the banks, the institutions the Democrats bullied to get those loans made. The progressives wanted to get more control over the country’s private financial institutions anyway, so why not use the results of their own failures to get that control? The result was the Dodd-Frank Act.

Destruction Wreaked by the Dodd-Frank Act

The economic damage wreaked by the Dodd-Frank Act has been enormous. It has added an enormous amount of new government regulations on banks, commodity markets, stock and bond brokers, investment advisors, and other members of the financial industry. One of the areas of greatest Dodd-Frank damage is in small community banks (also look here). Among the key areas of concern for community banks are increased reserves deposited with the Federal Reserve (more than doubled from $100,000 to $250,000 per depositor), additional regulatory hoops banks must jump through to qualify as an “accredited investor”, and the implementation of a modified Volcker rule that restricts their ability to invest in their communities. The bottom line for it all is that Dodd-Frank, in increasing compliance costs and regulatory burdens is making it difficult for community banks to make loans to all but their most credit-worthy customers. Historically, small community bankers used detailed knowledge of local businesses to fund those which were most promising for growth. Especially coming out of a recession, these small, young businesses were the greatest sources of new jobs. Since Dodd-Frank has made it much more difficult for community banks to do this job, we should not be surprised that the recovery from the 2007-2008 recession has been both slow and with very low growth rates.

Yet the damage on which I want to focus is not so much the actual economic damage caused by the act, but the damage done to our freedoms. There are very cogent reasons for believing the Obama administration has unconstitutionally seized powers under Dodd-Frank,

because (1) the act grants its agencies broad rulemaking, interpretative, and discretionary authority beyond effective oversight of either Congress or the judiciary, (2) those agencies have improperly exceeded even those unprecedentedly expansive statutory limits, and (3) those agencies have ignored and/ or not followed the law. [P5, Chapter 11, Section 1]

One of the major enforcement agencies set up by Dodd-Frank is the Consumer Financial Protection Bureau (CPFB), which is able to act as if it were beyond effective legislative oversight. This is because it was intentionally made a part of the Federal Reserve, placing one protected government agency within another. As long as the Federal Reserve is an independent agency, answerable to no one apart from periodic reports to Congress, the CPFB is essentially immune to the political system. Presumably, it does have to answer to the Federal Reserve Board of Governors, but if both bodies are dominated by progressives (as they appear to be presently), there is nothing others can do to limit its actions.

In particular, the Dodd-Frank act protects the CPFB from executive branch management or oversight. In addition, Congress can not reign-in the agency by cutting its funds in any way. Congress does not hold the power of the purse over it, because it is funded through the Federal Reserve’s budget, which is separate from the federal budget. In the words of the Act, the Federal Reserve’s Board of Governors “shall transfer to the [CFPB] from the combined earnings of the Federal Reserve System.” [Dodd-Frank, § 1017(a)(1)]. Dodd-Frank also explicitly states CPFB’s funds from the Federal Reserve “shall not be subject to review by the Committees on Appropriations of the House of Representatives and the Senate.” This means the CPFB director determines his own budget. Short of amending or repealing Dodd-Frank, there is precious little that anyone in the Federal Government can do to limit the agency’s scope. There is one lone safeguard against a CPFB run amuck. Another entity created by Dodd-Frank is the Financial Stability Oversight Council (FSOC), which can set aside a CPFB final regulation if it decides by a two-thirds vote that the regulation endangers the U.S. banking or financial system.

Alas the CPFB’s scope can be breath-taking. It has the power to administer and enforce federal consumer financial law with exclusive rule-making authority. Among the powers the CPFB asserts is the implementation and enforcement of all consumer-related laws involving finance and credit, and therefore the power to dictate U.S. credit allocation. If such an assertion is taken seriously, that pretty much covers power over all economic decisions. It and only it determines what products and conduct dealing with consumers’ market interactions fall within its purview. It enforces its own regulations. On the other hand the CPFB can exempt any product or service from its jurisdiction if it determines that to be “necessary or appropriate.” [Dodd-Frank, § 1022(b)(3)(A)] A more sweeping opportunity for political corruption and crony-capitalism can hardly be imagined.

Friedrich Hayek warned us long ago that the more economic power was centralized in the national government, the closer we came to a totalitarian state. The Dodd-Frank Act must be considered a very long step in that direction.

Views: 3,565