Stock Investors’ BIGGEST Enemy: Central Banks

The Shiller CAPE: The most trustworthy index on stock valuations

Image Credit: gurufocus.com

The question for the day is whether or not we should invest in the stock market. This should be an overwhelmingly important question for all of us! Investing in the stock market, either through 401K accounts or Individual Retirement Accounts (IRAs), has evolved into the primary (and for most people the only) way to save for retirement.

Why Do We Invest?

So why should anyone invest? To earn and store economic value for our retirement of course! Notice I used the phrase “economic value”, not “money” and not “profits”. Eventually we will want to take our profits and convert those profits into money to be used for either our retirement or other purposes, but until we sell our stock we are storing up economic value earned by the companies we buy. Money is merely an accounting tool used as a claim check for our share of economic value. This is an important distinction since it is the economic value of goods and services – also known as their utility or usefulness for us – that determines the actual wealth of a country.

Your purchase of a common stock is a form of savings because you are not actually consuming the wealth you earned at your job or through some other investment. As I described in the post The Importance of Personal and National Savings, our country’s savings are the only source for investment that exists, and the level of savings (and therefore of investment) determines whether our capability to produce wealth expands or contracts. Now there are some who think we already are producing too much to the detriment of both our environment and our humanity. Yet I suspect the poverty-stricken inhabitants of inner-cities would violently disagree if such a judgement were made by those who run the government. I personally as a member of the vast middle class am much better off than many others, yet there are a great number of things I do not have that could enrich my life and make me more comfortable. If I am not satisfied, I can only imagine how much more dissatisfied the poor are. I believe most others will agree with this observation.

By investing in a company’s stock you are performing a public service by directing some of the wealth you have earned with your own production into maintaining and expanding the nation’s productive capacity. Unless you are investing in a new issue of stock by buying it directly from the company, this contribution is indirect when you buy the stock from some other stockholder. They can choose to use some of the money you give them for the stock for consumption, but more often than not not they will turn around and buy the stock of some other company. In that case you have increased the total amount of produced wealth, i.e. capital, dedicated to the maintenance and expansion of the nation’s wealth production.

How Do We Determine the Value of Common Stocks?

But is it worth our while to invest in common stocks right now? It may well be at the present time that the economic environment does not justify foregoing consumption for investment. If most companies lack the opportunity for increased profits with increased investments, we (and the society) gain nothing by investing and not consuming. How can we answer this question?

One of the most important ways to answer it is to compare the price of a share of stock to the earnings per share (EPS) of some company whose stock we are considering. The current price of a stock divided by its EPS, called the price to earnings ratio or P/E ratio, gives the number of years you would have to hold the stock to double its value if its EPS stayed constant. This is because the EPS is universally quoted as the earnings per share per year. One can look at the P/E for a single company, or one can average the P/E over all the stocks in a market to gauge whether or not the market as a whole is underpriced, fairly priced or overpriced. The long-term average of all the stocks of the S&P 500 using the EPS of the trailing 12 months generally yields an average P/E between 16 and 17. The higher the earnings, the lower the P/E, which is desirable for the investor.

At this point the saying let the buyer beware should rule your analysis, as there are various ways of determining the EPS, which can be gamed to make stocks look more attractive. One common way is to use the anticipated EPS for the next year rather than the EPS of the last year, which would give the so-called “forward P/E”. This can be an exercise in wishful thinking to delude a prospective buyer of stock, or it might be due to some error of judgement. As of April first, the Wall Street Journal reported a trailing P/E for the S&P 500 of 23.82, while a forward P/E calculated by Birinyi Associates is given as 17.49. Which P/E is more accurate? Given our current problems, I suspect the trailing P/E is optimistic and the forward P/E is simply unrealistic.

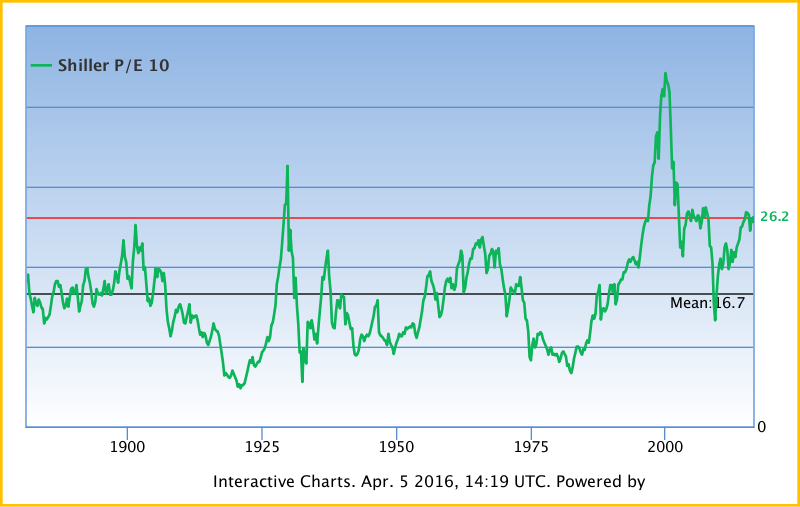

A professor of economics at Yale, Robert J. Shiller, who is also a recipient of the Nobel Memorial Prize for Economics, has invented the gold standard for P/E ratio calculation, which is the Cyclically Averaged Price to Earnings ratio or CAPE. It is also sometimes called the Shiller P/E or the P/E 10 ratio. To calculate the average EPS, he first corrects the EPS for inflation for the past ten years, so that the earnings are expressed in terms of current dollars. He then averages the inflation-corrected EPS over those ten years, and divides the current average price level of the S&P 500 stocks by the time-averaged and inflation-corrected EPS to get the CAPE.

The CAPE has been calculated as far back as 1881 up to the present, and during all that time has had a historical mean of 16.7. Currently, it has a value of 26.2, which is 56.9% above its historical mean. This would seem to tell us that most S&P 500 stocks are greatly overvalued.

The Enemies of Stock Investors

It would seem a great many investors agree with this assessment. Indeed, as I wrote in a recent post, A Corporate Earnings Recession Continues, there is much reason to believe only corporate buy-backs of their own stocks is keeping the S&P 500 bull market alive. That is not very surprising given that S&P 500 companies have been in an earnings recession for an entire year. If anything is surprising, it is that these companies still view these buy-backs as worthwhile. In any case with their worsening earnings, companies will encounter increasing difficulties in finding spare cash or in borrowing money to finance the buy-backs.

How could the stock markets have become so disconnected with economic reality? What we are currently experiencing is a very large stock asset bubble, which may be about to pop. As I noted in Echoes of the Great Depression: Japan, the historical progression of a bubble proceeds something like the following:

- A profitable asset in which to invest is identified during a period of vigorous economic growth.

- Even though these investments occur during vigorous growth, the central bank maintains an easy money policy to encourage further growth. Low interest loans to investors for buying the profitable asset are available and are used to increase demand for that asset.

- Euphoria over the increasing market valuations of the asset drive its price far above any fundamental value the asset has for the economy. The fact that the price of the asset continues to increase becomes the primary reason for buying more of the asset.

- At some point some of the smarter investors, noting the increasing disconnect between the fundamental economy and market valuations, begin to take profits by selling the asset.

- The bubble is pricked by increasing selling of the asset that turns into a panic. Once the bubble is pricked, it can not be re-inflated because by now no buyers can be found.

One big difference with this bubble compared with many others is that stocks were not identified as profitable assets for investment during a period of vigorous growth as in step 1 above. Instead, they were identified as profitable investments during one of the worst recoveries from recession since the Great Depression of the 1930s, and they were profitable only because the Federal Reserve provided free money at zero real interest rates to investment funds and others to buy the stocks. After a while when the stocks had risen to higher values, the borrowers could sell off some of their stocks to pay back the loans. This asset bubble began directly at step 2 of the progression above. In common with all other asset bubbles, however, is the Federal Reserve’s great culpability for this situation by providing the free-money fuel for inflating the bubble.

As long as the valuation of stocks is disconnected from economic reality, prospective investors will find actual investing to be hazardous to their economic health; and as long as U.S. companies find it more profitable to buy back their own stock than to invest in new productive capacity, the United States will find itself in increasingly grave economic condition.

Views: 1,787