How to Solve Problems in Chaotic Social Systems

The problem space: a system with chaotic boundaries

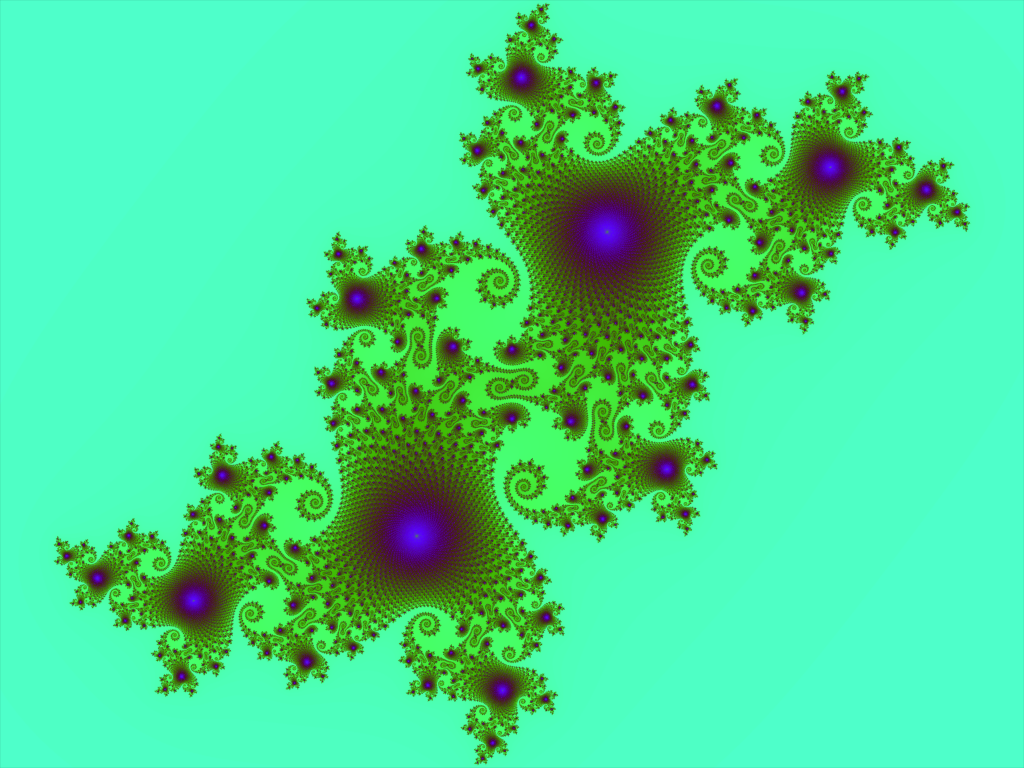

Image Credit: Wikimedia Commons/Eequor

In Central Planning for Chaotic Social Systems I discussed how social systems, particularly economic systems, are really chaotic systems. I suggested such systems might fruitfully be described using the mathematical theory of chaos. See reference [S3]. The ultimate reason for human social systems to be chaotic is that they are made up of a very large number of complicated human beings who interact with each other in a nontrivial number of complicated ways.

Complete Description of a Chaotic Economic System

To describe such a system you would need to specify the state of every interacting component or system “atom”. To do this you would need to assign a number of variables as coordinates in a state space that specifies attributes of interest in that system. Physicists give the name of “phase space” to a space with these kinds of coordinates. For example, in an economic system with individual people, companies and governments as atoms (an economist would call each atom an economic agent), one could specify the quantity and price that is desired by each economic agent from other agents for every good produced by the economy. Since everyone desires only a small subset of the goods an economy produces, most of those coordinates would be zero for most economic goods. In addition the quantity and price for each good an agent would be willing to produce would have to be specified. Then for each good an agent’s state would be specified by four numbers: the quantity and price for the good the agent desires to consume, and the quantity and price for which the agent is willing to produce. If the number of goods the economy produces is G, then the dimensionality of our economic phase space would be 4G, clearly a huge number. If there are N agents making up the economy, then the economy would be completely described by the positions of the N agents in our 4G dimensional phase space.

The hallmark of a chaotic system, called the “butterfly effect”, is its great sensitivity to initial conditions. If you were to produce two entirely identical systems except for some infinitesimal differences in the phase space positions of some of the individual atoms making up the systems, then at a later time the phase space positions of all the atoms could be vastly different in chaotic systems. At any one time points in the phase space could form fractal figures, as illustrated by the Julia Set in the two dimensional phase space in the figure above. Given initial conditions for the N points in the economic phase space, how well can we predict their future positions? Each point in the space represents a complicated individual human being or groups of human beings in the case of company or government agents, and they will interact with each other with time-varying desires and capabilities. The obvious answer is that it is statistically impossible to predict their future points. It could also be close to impossible to specify with any degree of precision which sub-volumes of the space they will occupy!

Now, suppose individuals within the government wish to stimulate the economy by changing positions of some points in the phase space within their capability. Can they be certain they will actually have a beneficial effect in increasing the GDP? The answer is obviously no, which certainly accords with the history of government control of economies.

Although I have described this problem in terms of an economic system, the description could be repeated for any complicated social system. The only difference would be in defining the variables to act as coordinates in that system’s phase space.

If Government Can Not Solve Social Problems, What Can?

Must we despair then of ever regaining a healthy, growing economy? Or of solving problems in any other social system? We must if we are to depend on government to do the job. No matter how complicated and nuanced an economic stimulus program is, it will create disturbances that will propagate throughout the system, many times in unpredictable directions. These disturbances might will push many points (which represent people or groups of people!) into undesirable positions of phase space that imply low incomes and levels of consumption. Obamacare is a very good example of such a program: It works well for the poor who are initially uninsured and who receive subsidies; it works horribly for most every one else.

The clue to a solution comes from the local nature of most economic or social interactions. Most economic transactions are with a small number of other individuals or individual companies. A government’s economic program for stimulating the economy attempts to affect the entire economy and must deal with all 4GN coordinates of the phase space. Individuals or companies in a typical transaction must deal with a much smaller number of variables belonging to the agents involved with the transaction. Therefore it is much easier for them to solve their individual, local problem than it is for the government to stimulate wisely the entire economy. All of the coordinates of the other phase space points not immediately involved with the transaction act as constraints on the choices of the transaction’s agents. As long as the transaction’s agents choose their own coordinates to be consistent within these constraints, the transaction will not upset phase space positions in other parts of the economy. In other words, by only paying attention to their own economic problems, agents have many fewer variables with which to deal and do not have to worry about creating a huge disturbance in the entire economy. By making their decisions consistent with economic constraints, such as the costs of raw materials obtained from other parts of the economy, economic agents make the solving of their local problems consistent with the condition of the rest of the economy.

But what gets changed when there is a recession? It has long been recognized, even by Keynesians, that in the long term a free-market will eventually adjust to economic problems and start to grow again. In its article on New Keynesian economics, Wikipedia states

New Keynesian economists fully agree with New Classical economists that in the long run, the classical dichotomy holds: changes in the money supply are neutral.

However, Keynesians say that “in the long run, we are all dead”. What they try to do is to speed up the process of recovery through their stimulus programs. The problem with this approach is that most state interventions into the economy have very disruptive effects, especially if they involve large state expenditures on goods and services that disrupt supply and demand relationships between economic agents in the private sector. This does not mean that government has no useful role in a recovery, as we discuss next.

Does Government Have Any Role?

Ever since the Great Depression of the 1930s, most economic crises in the United States have been caused fundamentally by the federal government. Certainly the Great Depression itself, as well as the Great Recession caused by the financial crisis of 2007-2008, were fundamentally due to the government. The very first thing to be done then is to stop whatever the government had done to cause the problem. In both of the crises I just cited, the Federal Reserve had a leading role. In the first, the Fed reduced the quantity of money by about 30%, making it impossible for the economy to support as many transactions as it once had. In our latest Great Recession the Fed had helped feed a real estate bubble. If the Federal Reserve would just adopt policies to keep the value of money constant, as described in the post The Ideal Monetary Policy, the Fed would be doing no harm, and at the same time would be reducing the scope of mischief into which the rest of the federal government could fall.

Often the Federal government makes our economy more inefficient through the adoption of ill-advised regulations. Two currently very applicable examples are all the regulations spawned by the Dodd-Frank Act and by Obamacare. Their repeal would give immediate boosts to the economy. Also, reigning-in the Environmental Protection Agency, particularly in its regulations to dominate water use and to reduce CO2 emissions, would greatly help economic growth.

As already stated, the big problem with most Keynesian stimulus programs is that by distorting private sector supply and demand relationships, they inhibit economic growth. One type of Keynesian stimulus program, not used since the Kennedy administration as a Keynesian stimulus, does not have this draw-back if done correctly. That is the tax cut. As long as a tax cut is not targeted to crony capitalists or some other special interest, the government is not choosing what is supplied or demanded in the economy. By leaving more of their money to the people and organizations that earned it, the government would stimulate private sector demand without distorting private sector supply and demand relationships. However, even more could be done by changing the structure of taxes, as discussed in The Ideal Tax Regime – 1 and The Ideal Tax Regime – 2. A flat-tax with a territorial tax approach, taxing only income in the United States and not income earned overseas, would do wonders for the economy without producing government distortions on what is demanded or produced. We have positive evidence this would increase economic growth, as discussed in The Rahn Curve, Hauser’s Law, the Laffer Curve and Flat Taxes.

The Political Problem

What was described as beneficial changes to government policies for economic growth in the previous section again boils down to a huge problem of political implementation. Just as I wrote at the end of What to Do About Keynesian Secular Stagnation, this is a great deal to ask politically and will generate determined political opposition, particularly from progressive Democrats. I can only hope the educational aid of the Obama administration’s history will help to persuade many that decentralization of power, particularly economic power, away from the government is vital.

Views: 2,595