Federal Expenditure and Revenue Realities

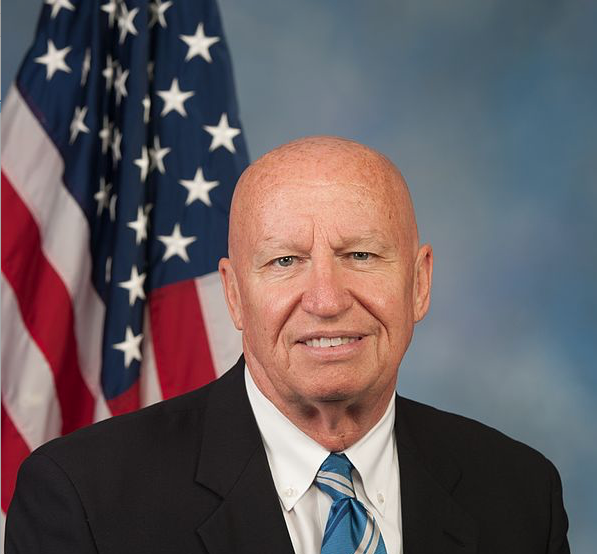

Rep. Kevin Brady (R-Texas), Chairman of the House Ways and Means Committee. Brady’s controversial plan for “border adjustment” taxes are being fiercely opposed.

Wikimedia Commons / Office of Congressman Kevin Brady

The Republicans in Congress are absorbed in a quandary. As for many of the rest of us with our own budgets, when congressmen find themselves in real financial trouble, many complications get in the way of finding a solution. As I have explored before in the post The Federal Government’s Projected Bankruptcy, the federal government is on the track to total insolvency within one to two decades. Yet, at the same time the Obama administration left national security problems that demand increased expenditures just to ensure the continued existence of the United States. Simultaneously, tax reform including large tax cuts both for the middle class and for American corporations are absolutely required to wake up our moribund economy. How can the Republicans reconcile these contradictions?

Our Economy’s Needs

There can be no ignoring the fact that much of the economically developed world is in deep, serious trouble. Even Keynesians, who have dominated governments’ economic policies since the Great Depression in the West and Japan, are admitting as much. As an exculpatory explanation for bad results to their policies, Keynesian economists motivated by Dr. Lawrence Summers are

Photo Credit: Wikimedia Commons/LHSummers

resurrecting the hoary Keynesian doctrine of Secular Stagnation. The “secular” part of the phrase refers to the fact that the economic stagnation is not a part of or explained by the business cycle, but is semi-permanent in nature. Invented by the economist Alvin Hansen in 1937, secular stagnation served to explain why the economy continued to grow so slowly despite all the government intervention during the Great Depression. Much of our current economic history seems very similar to the Great Depression, both in the high degree of government intrusion in the economy as well as in the very low levels of economic growth. Therefore, it is only natural that Keynesians should seek to explain current low growth in exactly the same way they attempted back then. The basic idea was that companies could not find profitable ways

Photo Credit: Rugusavay.com

to invest their capital, and not investing caused little increase in economic growth. In this view, low growth was caused by an intrinsic fault with laissez-faire capitalism itself.

Who can dispute the fact the industrial world has stagnate economies with barely perceptible economic growth? And as far as we can discern, this stagnation is occurring during the recovery from the Great Recession, and therefore is not attached to the business cycle. Yet, the Keynesians in searching for explanations in the intrinsic failures of free-markets are looking in all the wrong places. We can find more than sufficient explanations for the secular stagnation we see in a plethora of government failures. It is the governments of the West (and Japan) who have placed their jack-boots on the necks of their economies with high taxes and micro-managing regulations. Having already written a great deal on the many ways the American government has oppressed corporations to drive down economic growth, I will merely content myself with listing the links to some of these posts.

- The Burden of Economic Regulations

- Beware BEPS!

- Economic Effects of Current Tax Policy

- The Debilitating Effects of ObamaCare

- Economic Effects of the Dodd-Frank Act

- The EPA. CO2, Mercury Emissions, and “Green” Energy

- Big Corporations Abandoning the U.S. at an Increasing Rate

- Failures of New Keynesian Economics

- Economic Damage Created by the Fed

- The Fecklessness of the U.S. Federal Reserve

- The Keynesian Excuse: Secular Stagnation

- What to Do About Keynesian Secular Stagnation

- The Thoughts that Haunt Me

- Economic Freedom in the United States

- The U.S. Federal Government Budget

- The US is Drowning In Debt

- Why Isn’t the U.S. Economy Booming?

- Labor Market Not Nearly As Good As Many Think

- Perspectives on Unemployment

- Dirigisme No Longer Works. What Replaces It?

- Obama Has Not Produced An Economic Recovery

- The Federal Government’s Projected Bankruptcy

The posts linked above cover just a fraction of all the government failures driving our secular stagnation. Among the vital problems Donald Trump’s administration will have to address is the need to transfer more of the responsibility for capital allocation from the federal government to the private sector. What this means in practice is that the government will have to spend less and companies will have to spend more for investments. To accomplish this, large tax reductions (what the Keynesians call “tax expenditures”) will have to be made for both the middle class and for corporations. At the same time the Republican Congress will be trying to reduce government deficit spending, absolutely necessary tax reductions will be worsening the government’s fiscal position. How can they possibly “square the circle?”

The Demands of National Security

Yet, indispensable reductions in federal taxes are not the only way the government’s fiscal position will erode. Among other dubious gifts of the Obama administration to Donald Trump, we have a number of growing existential threats. Outside of ISIS, the U.S.’s most serious enemies — Russia, China, and Iran — have combined together in an informal alliance to oppose the U.S. and its allies. From the moment Obama went on his first “international apology tour” early in his first term, it was clear he viewed the U.S. as being fundamentally at fault in exacerbating if not creating many of the problems between countries. He told the French that toward Europe, America “has shown arrogance and been dismissive, even derisive”. In London, Latin America, and Egypt he expressed similar mea culpas, seeming to project a moral equivalence between the United States and its adversaries.

Obama also had the belief that if he could draw each of the members of the Russia, China, Iran axis into negotiations, he could get them to cooperate in the solution of international problems. What was the payoff for these policies? Russia continues to seek ways to retake the Baltic Sea states and the erstwhile Russian possessions in Eastern Europe, Georgia, and Ukraine, as well as to emasculate NATO. China not only has stepped up its cyber attacks of both corporate and U.S. government computer systems, but is attempting to threaten world maritime trade by claiming large portions of the South and East China Seas to be part of China. Meanwhile, Iran has continued its provocative behavior against the U.S. Navy in the Persian Gulf and by continuing ballistic missile tests. Since Obama believed the United States to be the largest international malefactor, he of course wanted to withdraw the United States as much as possible from the affairs of nations. As a benefit of this course, he believed he could transfer a great amount of the Defense Department’s assets to domestic programs, hollowing out the U.S. armed forces.

Now, the new Trump administration is left with the challenges of these three revisionist regimes. Both Russia and China especially pose existential threats. They both possess nuclear weapons, and ICBMs on which to put them, and they are both developing Hypersonic Glide Vehicles (HGVs) for nuclear delivery. Meanwhile, Iran continues to develop the technology for nuclear-tipped missiles. At the very minimum, Trump needs to spend a great deal to bolster our armed forces and our missile defenses, which the Obama administration also allowed to decay. Just to survive as a country, a very large increase in federal expenditures for national defense must be made. How can this be done and still have the U.S. government escape insolvency?

The Congress’ Quandary

This brings us to the current Republican quandary in the Congress. They must both cut taxes (corporate taxes from 35% to 20%, as well as individual taxes) and increase defense spending while still allowing the federal government to survive financially. The Wall Street Journal has just reported in the post As Tax Debate Heats Up, Lawmakers Struggle to Think of a Plan B on this Republican problem. To help defray the revenue losses from tax cuts, the chairman of the House Ways and Means Committee, Rep. Kevin Brady (R-Texas), is pushing the idea of “border adjustment” taxes. These taxes would be added to imports and subtracted from exports; the proposed import rate is 20%. The corporate income from exports would not be counted as income for tax purposes. Therefore, this is a mercantilist measure that would add federal revenue if there were more imports than exports; it would never add a federal expenditure except as a so-called “tax expenditure” if exports were larger than imports. Because imports have consistently been larger than exports, this border adjustment tax would help counteract other tax decreases. The Trump administration has been considering such taxes as a way to get Mexico to pay for “the Wall” between the U,S. and Mexico, as well as a means to discourage American production migrating outside the country. However, because these border adjustment taxes are also transparently mercantilist, many retailers are vigorously resisting them as detrimental to their businesses.

In fact, congressional Republicans are caught between the proverbial rock and a hard place fiscally. They have absolutely no choice but to enact large tax cuts in order to restart the American economy. They also have no choice but to increase defense expenditures to defend against threats from ISIS, Russia, Iran, and China. Neither of these subtractions from the bottom line helps to maintain the federal government’s fiscal health, and government expenditures are increasing greatly on auto-pilot just from increases in mandatory entitlement spending.

At least some relief can be expected from economic growth partially generated from large tax cuts and reductions in economic regulations. How much help can be obtained from economic growth, however, is controversial. Progressives claim we could increase government fiscal health by increasing tax rates, but this claim contradicts everything we actually know about the economy from observation. There is an entirely empirical economic law called Hauser’s Law, which says that

Image Credit: Wikimedia commons

no matter what the tax rates are, government revenues will always be around 19% of GDP, give or take a few percent. However, increasing tax rates will always reduce economic output of whatever is taxed and reduce the GDP, thereby reducing total government revenues. Increasing tax rates can be depended to worsen the government’s fiscal health.

Some help can be found from reducing government discretionary spending, but the problem with that idea is that there is so little of it. Altogether, discretionary spending takes about only about a third (32%) of the federal budget, as attested by the pie chart below.

Image Credit: USBudgetAlert.com

Of this discretionary spending, half (16%) is defense spending that must be increased. If the fiscal-health problem can not be solved by increasing tax rates nor by decreasing government discretionary expenditures, and the amount of help that can be found from economic growth is controversial, about the only thing left to help out is decreases in mandatory entitlement spending, i.e. Social Security, Medicare, and Medicaid spending. Currently this amounts to two-thirds of the federal budget and is its fastest growing piece. In fact, fiscal disaster is guaranteed if this mandatory spending is not sharply reduced. Consider the extrapolation of current mandatory spending below.

Data Source: Historical Tables 2016, U.S. Government Budget

The green curve is an exponential curve fit to total federal government revenues, extrapolated to the year 2045. The blue curve is a similar fit to total mandatory entitlement spending plus interest on the national debt. As you can see from the extrapolations, if entitlement spending does not change and/or federal revenue is not increased by growth in the economy, then sometime in April 2031, mandatory entitlement spending plus interest on the national debt will totally absorb every single penny of federal revenues. Long before then, mandatory plus discretionary spending will achieve the same result.

You can see the stubborn problems the Congress has if they refuse to decrease entitlement spending.

Views: 2,234