Federal Budget Deficits to Rise Again in 2016

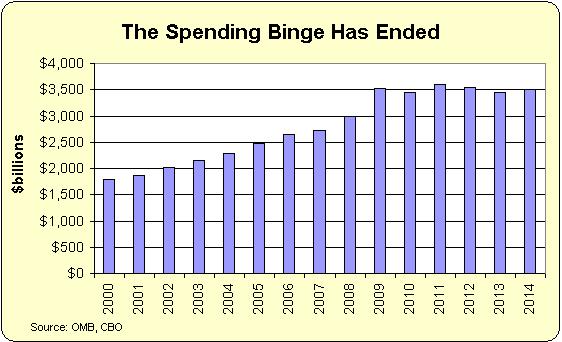

Budget Stops Growing! (But not for long.) Image Credit: International Liberty

It was not supposed to be this way! Federal spending and budget deficits were supposed to be controlled by sequestration until 2021! The bar chart above was prominently displayed as the post theme image for my post Federal Budget Deficits and Spending Restraints because it showed federal spending being relatively constant from 2010 through 2014. Dan Mitchell, who blogs on the International Liberty website, created the chart using data from the Congressional Budget Office, to show federal expenditures had been brought under control. As I pointed out in my previous post, much of the spending restraint came from TARP repayments, which for some reason were considered “negative expenditures” in the budget. However, some spending restraint came from budget sequestration beginning in January 2013. By the beginning of 2014, TARP repayments were pretty much a spent force for reducing expenditures, as you can see in the chart below.

However, Mitchell also showed that with just a little bit of budget restraint, the federal government could continuously reduce the deficit until the budget was balanced in just a few years. Using the chart shown below, he noted any budget growing less than 3% per year would balance sometime before 2025.

Of course, President Obama and top Democrats have tried to take credit for the federal budget deficit having fallen by about two-thirds during his administration. What he does not point out, however, is that the budget deficit first exploded on his watch, and has since dropped only with the combined influences of TARP repayments, budget sequestration forced on him by a Republican house, and a very modest economic recovery. Precious little, if anything, of all this can be claimed rightfully by Obama.

Unfortunately, the Congressional Budget Office (CBO) has just informed us in their annual budget and economic outlook report that the budget deficit will again begin to rise this year – approximately 5 years early – after six years of decline. This was not supposed to happen until 2021 when sequestration was to end! After that, spending was to skyrocket again because of the entitlements – Social Security, Medicare, and Medicaid. In their report the CBO tells us

As a percentage of GDP, the deficit remains at roughly 2.9 percent through 2018, starts to rise, and reaches 4.9 percent by the end of the 10-year projection.

With the deficit rising again, the actual federal debt held by the public from 1940 to 2015 and the projected debt after 2015 is shown in the plot below. This is the part of the debt not held by the Federal Reserve or other governments and must be repaid by means of either taxes or roll over of the Treasury bonds.

Now, by 2025 just that portion of the national debt held by the public will be over 80% of GDP, and according to Carmen Reinhart and Kenneth Rogoff, this is almost enough all by itself to start crowding out corporations from capital markets in the competition for capital. (Actually, with a total national debt currently at 100%, we are already there.)

As always, it seems that federal deficits and the national debt always increase faster than we expect. The writing is on the wall.

Views: 3,600