Can Hauser’s Law Be Repealed?

Hauser’s Curve Image Credit: Wikimedia commons/Sugar-Baby-Love

American progressives want a much bigger government with greater powers, while neoliberals (usually mislabeled “conservatives”) passionately want a greatly smaller, weaker government. The reasons for the neoliberal resistance to progressive policies are that neoliberals believe those policies to be incompatible with both human freedom and general economic prosperity.

The interaction of Hauser’s Law with Rahn’s Law provides an important neoliberal argument for limiting both government taxes and government spending. However, Hauser’s Law is an economic “law” only by courtesy of the fact that it has always been observed to be true in the United States for the past seven decades or so. If it can be repealed, that economic change could expose a serious flaw in the neoliberal picture of economic reality.

A friend and critic of mine on the progressive side of the argument pointed out an explanation for Hauser’s Law that shows how it might be repealed. Let us take a careful look at it.

Hauser’s Law and Its Explanation

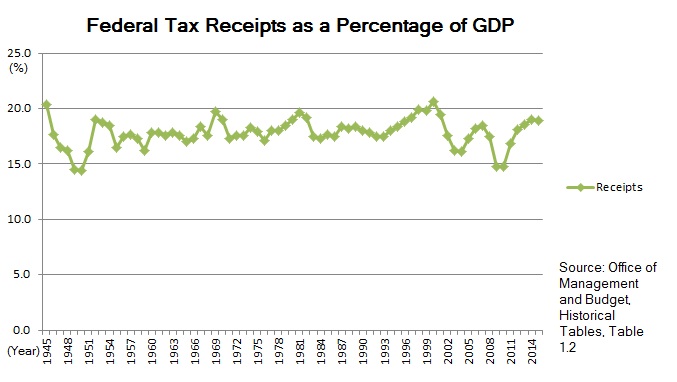

What Hauser’s Law states, as illustrated by Hauser’s curve at the top of this post, is that no matter what the top marginal tax rates, federal tax receipts have stubbornly averaged 19.5% of GDP, plus or minus a few percentage points. In fact, the largest fluctuations from the 19.5% average are downward, and are lagging indicators of particularly severe recessions. Whatever the possibilities for its repeal, the law’s nullification can not be achieved simply by raising the top marginal tax, as demonstrated by the plot below.

Hoover Institution / W. Kurt Hauser and David Ranson

Another way of looking at Hauser’s Law through time is provided by David Ranson in a plot taken from a Wall Street Journal essay. In the plot below, the vertical axis shows federal tax receipts in billions of dollars, while the horizontal axis gives the GDP in trillions of dollars.

Wall Street Journal / David Ranson

What this graph emphasizes is that in the American system, if you truly want to increase government revenues, you must do everything you can to increase the size of the GDP. However, suppose government can get around Hauser’s law and hog a larger fraction of the national income. Then, it would not have to depend on a growing economy to get more assets. If we can understand why Hauser’s Law has worked for such a long time, perhaps progressive politicians can find a way to revoke it.

A plausible explanation for Hauser’s Law is provided by the neoliberal economist and pundit Daniel J. Mitchell in a 2010 Forbes post entitled Will “Hauser’s Law” Protect Us from Revenue-Hungry Politicians?. Mr. Mitchell is not at all optimistic that Hauser’s law can protect us forever from greedy politicians, because so many other countries tax away much larger fractions of their GDP. You can verify this by looking at the OECD comparative tables giving countries’ total tax revenues as a percent of GDP. In looking at those tables, you should be aware that they include taxes at all levels of government. Therefore, the entry for the U.S. gives total government 2016 revenues not at around 20% of GDP, but at 26% once an average 6% for state and local taxes is added. Looking through the tables for the year 2016 you can find countries with taxation as a fraction of GDP that are truly astounding. Cherry-picking some of the higher tax burdens, we find Denmark taxes away 45.9% of GDP, France 45.3%, and Italy 42.9%. At the lower end of the OECD scale, we find Ireland at 23.0%, South Korea 26.3%, Switzerland 27.8%, and the United States 26.0%.

So what is the explanation for how the high tax countries can monopolize such a large fraction of their national incomes? Why is it that the U.S. federal tax revenues have always hovered around 20% of GDP? Mitchell says the answers to these two questions lie in a great cultural aversion to regressive taxes in the United States, together with the lack of such an aversion in other countries, particularly in Europe. Income levels at which European taxes reach their top rate are incredibly small compared to the corresponding U.S. income levels. To support this claim, he offers the chart below, which he says used data from several years previous to his May 2010 post. (Unfortunately, links he provides to web pages that contain the data have died over the years, so all we know is the data was from a few years prior to 2010.)

Forbes / Daniel J. Mitchell

Suppose that as in Europe the top marginal tax rate in the U.S. began at $58,000 of adjusted income (after all deductions have been subtracted). Just to be generous, let us take that top marginal tax rate to be the new lower one enacted in the Tax Cuts and Jobs Act, which is 37%. Then the taxes out of $58,000 would be $21,460, leaving the taxpayer with a disposable income of $36,540. How long after proposing such a tax change do you think it would be before irate taxpayers would begin lynching the responsible politicians?

But the regressive taxation in Europe does not end with low incomes being taxed at the maximum rates! In addition, most European countries (if not all) have this fiendishly effective method for separating a poor citizen from his money called a Value Added Tax (VAT). Below is a video featuring Dan Mitchell himself explaining the VAT’s effects on European revenues and expenditures vis-à-vis those of the U.S.

But Do We Really Want to Repeal It?

So, yes, we can repeal Hauser’s Law! All we have to do is to greatly lower the income level at which the maximum tax rates are assessed down to the lower middle class, and add a VAT on top of the income tax. However, I would expect a very heavy political lift for any politician trying to persuade ordinary citizens to accept such confiscatory tax rates.

Do we really want to do this? The only reason to get rid of the restraint of Hauser’s Law is to allow the federal government to allocate a much larger share of GDP for government’s purposes, which more often than not are not the purposes of individual citizens, companies, or other economic agents. The proposition government can allocate the economy’s resources for a much greater benefit for society than could citizens and companies is part of the most basic lie progressives tell to themselves and others. The proposition is partly motivated by another set of lies they tell about companies, that companies are basically enemies of the American people, and that they can not be trusted to get us out of economic bad times. Only government in the view of progressives can provide the stimulus to revive the economy.

What is the benefit of having government allocate a larger share of GDP? The history of the past two and a half centuries, and particularly of the past century, screams out that government control of the economy ultimately freezes it into inactivity. Just ask Venezuela, Cuba, North Korea, and the erstwhile Soviet Union. Ask Iran today, which may be at the beginning of an incipient civil rebellion. More than that, as increasing amounts of economic power are devoured by the state, eventually a tipping point is reached in which the masters of the state extinguish political freedom. Ask Friedrich Hayek, who watched the democratic Weimar Republic evolve into Nazi Germany. You say it can not happen here in the United States? Consider my post The Anti-Freedom Bias of Progressives.

I suspect my progressive friend, who pointed out Dan Mitchell’s old post to me, would say some measure of “average happiness”, bought by government welfare programs, is preferable to economic growth. My reply is that progressive economic policies have created economic stagnation and brought us close to secular economic contraction and federal government insolvency. While material well-being may not buy happiness, the lack of it will certainly create misery. And there can be no happiness under a tyrannical government.

Views: 2,586