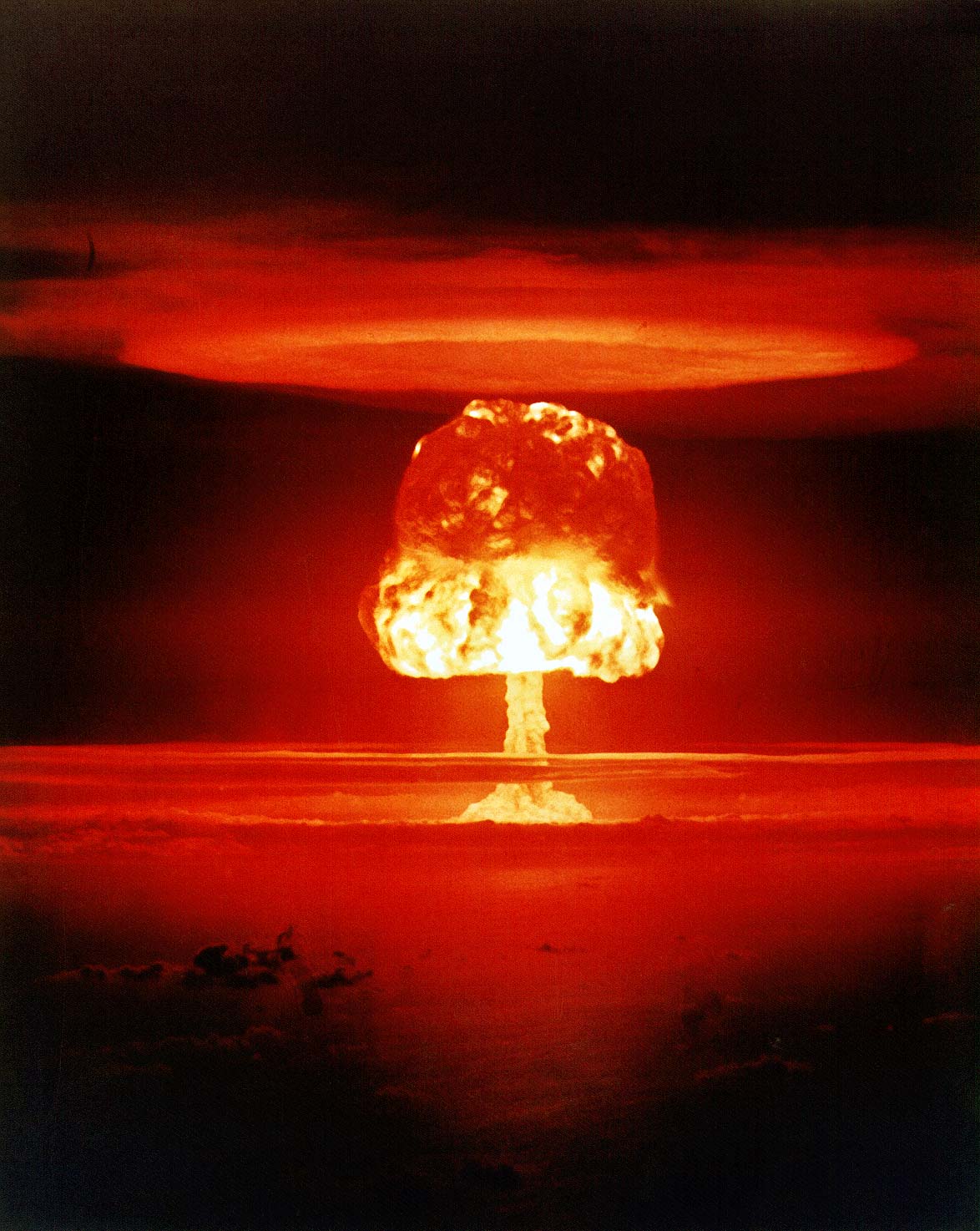

Blowing Up the New Keynesian Model

Demolition Explosion! Photo Credit: U.S. Department of Energy

I am beginning to see suggestions that it is time to blow up New Keynesian economics to smithereens and replace it with something else. I have suggested as much in my post Bending History, but junking New Keynesian economics is such a natural thought, I very much doubt I have pride of place. What brought this subject to mind again was the post Is it time to blow up the New Keynesian model? by Scott Sumner, a monetarist. Now Sumner and the folks he cites may or may not be hoping to replace the New Keynesian economics with the same kind of economic viewpoint as me, but having read their objections, we at least agree on most of the shortcomings of New Keynesian doctrine.

Before we get into the meat of the subject, let’s make sure we all know the meanings of the labels (labels do matter!). To understand the next paragraph, you must have some understanding of what neoclassical economics is and what the original Keynesianism was all about. You can more or less satisfy this requirement if you read the posts The Keynesian-Neoclassical Ideological Conflict (1) and The Keynesian-Neoclassical Ideological Conflict (2). Also a reading of all the posts in the Laws of Economics theme can help a great deal.

New Keynesians are members of that sect of the religious order of economics that believes in the new neoclassical synthesis. The old neoclassical synthesis that held sway from the 1950s through the 1970s was a grafting of neoclassical microeconomic ideas onto the original Keynesian macroeconomics. The brand of Keynesians who believed in the old neoclassical synthesis were sometimes known as neo-Keynesians. This mixture of ideas however ran into trouble with the advent of stagflation in the middle and late 1970s, which the old neo-Keynesians said could not possibly exist. The New Keynesians tried to solve this problem with the addition of monetarist ideas from the monetarism of Milton Friedman, plus ideas about the effects of “sticky” wages and prices on the older neoclassical model, and reactions to Robert Lucas’ “Rational Expectations” hypothesis; this yielded the new neoclassical synthesis, The resulting overall New Keynesian economic model had three major pieces. If the start-time is defined as the time a recession or other large perturbation of the economy from long-term equilibrium starts, the model divides into short-term, intermediate-term, and long-term pieces.

- On the short run the original Keynesian economic model is believed to be an accurate rendition of the economy. One major assumption of the original Keynesian model is that prices are constant; there is no inflation or deflation present. This places a time limit on the accuracy of a pure Keynesian model as the period during which wages and prices are substantially constant; i.e. about a year or less.

- In the intermediate term, between the end of a pure Keynesian model’s efficacy and a longer term when sticky wages and prices adjust to supply and demand curves and neoclassical microeconomics holds sway, is where the bulk of the new neoclassical synthesis reigns. A new tool in the form of monetary policy is given to optimize economic output, i.e. GDP. In this regime the central bank can lower interest rates to encourage growth if the GDP is below its potential; and it can similarly increase interest rates to reign in inflation if the GDP is above its potential. Once sticky wages and prices begin to adjust to supply and demand pressures, this intermediate term is finished.

- In the long term all New Keynesians agree the neoclassical model of the economy is its best description.

Over the years the New Keynesians have developed a number of predictions that are patently absurd. In his post Scott Sumner takes note of a New York Federal Reserve Bank Staff Report by Gauti Eggertsson, a New Keynesian professor of economics at Brown University. In particular, Sumner quotes the paper’s abstract to set the stage for his objections against New Keynesianism, and I shall do the same.

Tax cuts can deepen a recession if the short-term nominal interest rate is zero, according to a standard New Keynesian business cycle model. An example of a contractionary tax cut is a reduction in taxes on wages. This tax cut deepens a recession because it increases deflationary pressures. Another example is a cut in capital taxes. This tax cut deepens a recession because it encourages people to save instead of spend at a time when more spending is needed. Fiscal policies aimed directly at stimulating aggregate demand work better. These policies include 1) a temporary increase in government spending; and 2) tax cuts aimed directly at stimulating aggregate demand rather than aggregate supply, such as an investment tax credit or a cut in sales taxes. The results are specific to an environment in which the interest rate is close to zero, as observed in large parts of the world today.

In this abstract one can see the Keynesian biases against saving and allowing people to dispose of their own money, because of the Keynesian expectation people will stick their money under the mattress, or save it in some other way. It shows the Keynesian belief that government expenditures are a more certain mode of economic stimulus, and that any tax cuts should only be of a type that will encourage people to spend and companies to invest. No mention is made that any tax credits for businesses usually specify what types of investments are allowed for the credit, and therefore interfere with supply and demand balance. As I have written in a number of posts, the government has proved to be a very bad investor.

Eggertsson does say these policies are “specific to an environment in which the interest rate is close to zero, as observed in large parts of the world today”, but they seem to be the standard vanilla, original style Keynesianism of the 1930s. Sumner also notes Eggertson demonstrates elsewhere that the New Keynesian model suggests artificial increases of the minimum wage could be expansionary. To say something like that ignores the possibility, or in today’s technological world even the probability, that businesses will let low wage workers go, rather than give them wages greater than their economic productivity justifies.

Sumner goes on to list a number of other incorrect, absurd implications of New Keynesian models:

- Higher taxes on wages can be expansionary.

- Higher capital gains taxes can be expansionary.

- Raising the aggregate wage level by government decree can be expansionary.

Any of these New Keynesian policies would certainly result in discouragement of private sector economic activity. The first two listed are just flat-out wrong, and can only pretend to be correct if increased government revenues from the taxes are spent by the government in a way that actually stimulates the economy without distorting existing supply-demand relationships. The third point is border-line insane, since paying workers more than their production justifies will result in company losses that would eventually destroy them. The companies would certainly not hire any new workers under those conditions. How can that be expansionary?

Sumner lists two more New Keynesian recommendations as incorrect, which I find merely problematical.

- An increase in short-term interest rates by raising the fed funds target interest rate can be expansionary

- Fiscal austerity can be expansionary if done by slowing the growth in government.

In the short term an increase in short term interest rates can not ever be expansionary; but what is most important for the health of the economy is keeping the value of the dollar constant. If that is not done and the dollar varies a lot in value, it would be next to impossible to maintain balance in supply-demand relationships. See The Ideal Monetary Policy.

Concerning the last point, I find it hard to believe any Keynesian would make that statement, as they view the government as the main engine of growth in hard times. In fact, reduction of government expenditures accompanied with reductions in taxes should be profoundly stimulating. There might well be some short-term repercussions as businesses supplying government lose income. However, by sending investment and consumption decisions to the private sector, the government allows Adam Smith’s invisible hand to work more of its magic. Also read Adam Smith’s “Invisible Hand” and Evolution.

There are other problems with New Keynesian economics, particularly with their concept of potential GDP growth rate, which they usually take as constant, and whose changes they have a hard time handling. I plan on discussing this in a future post. Even more telling, however, is their view that economic problems always stem from a free-market failure. Yet, most if not all economic crises in the past century have their causes in government bad economic policies, which includes the Federal Reserve. See The Causes of the Great Depression, Why Did the Great Depression Last so Long and Causes of the 2007-2008 U.S. Financial Crisis.

If you can not accurately determine the causes of problems, it is unlikely you will find an effective solution. If the mechanisms of your model predict absurdities, it is time to quit the game.

Views: 2,599