Are Leftist Economies Better Than Free-Markets?

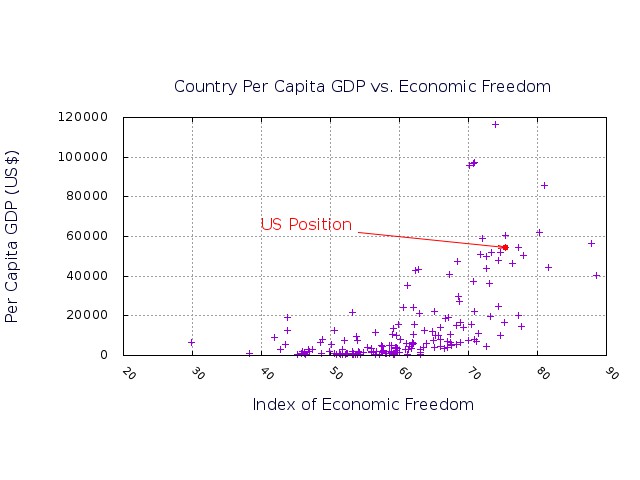

Country per capita GDP vs. WSJ/Heritage Foundation Index of Economic Freedom for 195 nations

Data courtesy of Wall Street Journal/Heritage Foundation and the World Bank

In a comment to the post Comparing the Economies of All Countries on Earth, a reader noted:

One thing that you don’t talk about is that several of the highest ranking “economic freedom” countries are places where progressives have had freer rein to experiment with social democracy, or perhaps even democratic socialism, such as Canada, Estonia, Denmark, and the UK. I don’t see why you frame the discussion as progressive bad vs. conservative good when there are countries with “progressive” economics that rank as highly in economic freedom as the US.

I explained why I thought American progressives were very bad, indeed, in my last post, Are You Unconvinced Democrats Are Growing More Authoritarian? In this essay I will question the commenter’s presumption that “several of the highest ranking ‘economic freedom’ countries are places where progressives have had freer rein to experiment with social democracy, or perhaps even democratic socialism, such as Canada, Estonia, Denmark, and the UK.” The implicit question begging to be asked has an answer I believe to be very different from what is often assumed. The question is: Does the United States have an economy that is much more of a free-market than can be found in Canada, Estonia, Denmark, the U.K., and other European nations? I claim the answer, depending on the compared country, is quite often shockingly no!

The Data

In fact, it should be obvious from the scatter plot above, there are a fair number of countries with better claims to having free-markets than the U.S. More precisely there are ten of them. Listed in descending order of economic freedom down to the U.S., they are shown below along with 2014 economic data (the latest data available from the World Bank’s website). I have also included data for some other notable European nations.

| Country | Rank | Economic Freedom Index | Per Capita GDP (US$) | GDP Growth Rate (%) | GINI Index |

| Hong Kong | 1 | 88.6 | $40,169.50 | 2.5 | N.A. |

| Singapore | 2 | 87.6 | $56,284.30 | 2.9 | N.A. |

| New Zealand | 3 | 81.6 | $44,342.20 | 3.0 | N.A. |

| Switzerland | 4 | 81.0 | $85.616.60 | 2.5 | 31.6 |

| Australia | 5 | 80.3 | $61,979.90 | 2.5 | N.A. |

| Canada | 6 | 78.0 | $50,230.80 | 2.4 | N.A. |

| Chile | 7 | 77.7 | $14,528.30 | 1.9 | 50.5 |

| Ireland | 8 | 77.3 | $54,339.30 | 5.2 | 32.5 |

| Estonia | 9 | 77.2 | $20,147.80 | 2.9 | 33.2 |

| United Kingdom | 10 | 76.4 | $46,297.00 | 2.9 | 32.6 |

| United States | 11 | 75.4 | $54,629.50 | 2.4 | 41.1 |

| Denmark | 12 | 75.3 | $60,718.40 | 1.1 | 29.1 |

| Lithuania | 13 | 75.2 | $16,489.70 | 3.0 | 35.2 |

| The Netherlands | 16 | 74.6 | $52,138.70 | 1.0 | 28.0 |

| Germany | 17 | 74.4 | $47,773.90 | 1.6 | 30.1 |

| Finland | 24 | 72.6 | $49,842.70 | -0.4 | 27.1 |

| Sweden | 26 | 72.0 | $58,898.90 | 2.3 | 27.3 |

| Austria | 28 | 71.7 | $51,122.40 | 0.4 | 30.5 |

| Norway | 32 | 70.8 | $97,299.60 | 2.2 | 35.9 |

| Latvia | 36 | 70.4 | $15,692.20 | 2.4 | 35.5 |

| Spain | 43 | 68.5 | $29,721.60 | 1.4 | 35.9 |

| France | 75 | 62.3 | $42,725.70 | 0.2 | 33.1 |

| Italy | 86 | 61.2 | $35,222.80 | -0.4 | 35.2 |

| Greece | 138 | 53.2 | $21,672.70 | 0.7 | 36.7 |

Every one of the ten countries with higher rank in economic freedom can claim to have freer markets than the United States. To get a better feel for the relationships between a subset of these nations, I made a scatter plot of their positions in the plane of the economic-freedom-index and per capita GDP. Included were all the states mentioned in the comment above, plus the remainder of the Scandinavian and Baltic Sea states.

Data sources: WSJ/Heritage Foundation and the World Bank

Notice that all these nations occupy a very small section of the Economic Freedom Index axis between 70.4 for Latvia (the least free of the group) and 78.0 for Canada (the most free of the group). Also notice the Baltic Sea States have relatively low per capita GDP in the neighborhood of $20,000, and that Denmark has the state point closest to that of the U.S. If we now look at these state points in the plane of the economic-freedom-index and GINI index, we get the following plot.

Data Sources: WSJ/Heritage Foundation and the World Bank.

Notice here that we have lost the Canadian point, since no GINI index is available for it. It is useful to compare the area of this plane that these states inhabit relative to the area of the plane covered by all states for which we have GINI indices. I reproduce the plot for all countries below.

Data Sources: WSJ/Heritage Foundation and the World Bank.

Clearly, the subset of countries we are studying cluster relatively close together relative to the area covered by all nations. Nevertheless, the United States does have the highest GINI index in this subset, meaning it has the least equal income distribution. It is also roughly in the middle of GINI indices for all nations.

Can We Really Think the U.S. Has A Free-Market Economy?

So how are we to make sense of all this data? The very first point I would like to make is that since the United States has been increasingly diverging from a free market over a period of decades, it can hardly be viewed as a paragon of a laissez-faire, free-market economy. One can not just point to social and economic failings of the United States and claim with a straight face those failings are due to capitalism.

If one looks closely at U.S. economic history, at least since the beginning of the 1920s, it is very easy to discern almost all, if not in fact all, of the major U.S. recessions were caused by federal government failures, not market failures. This statement is true for both the Great Depression of the 1930s and the Great Recession of 2008-2009. The 1920-1921 recession (they called it a depression back in those days) started almost in the same way as the Great Depression with a frothy economy that crashed. However, in the 1920-21 recession the federal government did essentially nothing, and while sharp, the recession was also very short. The essentially free-market of the time was self-correcting. However, in the case of the Great Depression, the Federal Reserve reduced the M2 money supply by fully a third, causing horrendous deflation. If the government had treated the recession started by the 1929 stock market crash in the same way as the 1920-21 recession, the Great Depression would probably have remained a garden-variety recession, short and sharp. Instead the deflation created by the Federal Reserve caused the banking system to collapse in the period 1930 to 1933, which was the true start of the Great Depression. In addition, the Franklin Roosevelt administration initiated so many anti-free-market policies the economy had great difficulty recovering and dragged on for approximately nine years,

In the recovery following the 2008-2009 recession, our federal government has again instituted so many anti-free-market programs that the recovery has been stunted and the economy slow growing with average annual growth of a little better than two percent. I have covered much of the government’s baleful effect on the economy in the post Economic Damage Created by the Fed, and in the posts of the themes U.S. Government Economic Regulations and Taxes.

To see how all this government activity has affected inequality of income distribution, let us look at a hint given us by the recent time-behavior of the U.S. GINI index, displayed in the plot below. The data points obtained from the World Bank are three years apart. Also recall that the higher the GINI, the greater the inequality of income distribution.

Image Credit: St. Louis Federal Reserve District Bank/FRED, Data Source: The World Bank

The red line in the plot is a linear fit to the data. Note that the biggest fluctuation from the trend line is from the the first year of the 2007-2008 financial crisis initiating the Great Recession. If that one point were more like the others, the trend line would be horizontal instead of rising slowly. In fact if there had been no Great Recession — caused jointly by the Federal Reserve and the legislative and executive branches of the federal government — the economy might well have followed a trajectory of declining GINI index. The economic denial of good paying jobs to the middle class has certainly been part of the cause of the rising GINI. If instead of intensive government intervention in the economy we had much greater economic freedom, the scatter plot above of all countries’ GINI index versus economic freedom suggests strongly we would have a much smaller GINI and more equitable income distribution.

Do Canada, Estonia, Denmark, and the U.K. Have More Leftist Economies?

I am now in a position to evaluate my interlocutor’s comment that “several of the highest ranking “economic freedom” countries are places where progressives have had freer rein to experiment with social democracy, or perhaps even democratic socialism, such as Canada, Estonia, Denmark, and the UK.” To equate higher economic freedom with “freer rein to experiment with social democracy” is an obvious contradiction in terms. If the index of economic freedom has any accuracy at all in measuring lack of government intrusion, a higher index should indicate less government management of the economy, not more. Perusing the table of data above, you can verify all of the countries mentioned, with the exception of Denmark, had higher degrees of economic freedom according to the index. And Denmark had almost the same value for the index as the United States.This means those countries with larger indices had even less government economic intrusion than the U.S.!

Let us consider how the index of economic freedom is calculated to see if it indeed does what we think it should. To calculate the index for any particular country, the Wall Street Journal and the Heritage Foundation scored each nation from 0 to 100 on ten factors of economic freedom, separated into four categories. The categories and their constituent factors are:

- Rule of Law

- Property Rights

- Freedom from corruption

- Limited Government

- Fiscal Freedom from taxes

- Government Size/Spending

- Regulatory Efficiency

- Business Freedom from Regulations

- Labor Freedom from Regulations

- Monetary Freedom from Inflation/Deflation

- Open Markets

- Trade Freedom from tariffs and non-tariff barriers to international trade.

- Investment Freedom from restrictions on the movement and use of investment capital.

- Financial Freedom from government control and interference in the financial sector, including banks.

The index value is then an average of these scores. An index of 0 denotes no economic freedom from the government whatsoever, while a score of 100 indicates a perfectly free laissez-faire economy. To be sure, a country with a higher index than another might score less well on some particular factor, but the average of all of them ensures a higher index implies exactly what we thought.

My conclusion is the less government management of the economy there is, the more prosperous a nation will be and the more equitably its GDP will be distributed among the people. To close out this essay I will post a 2014 Youtube video below produced by the CBN network that vividly illustrates what happens to a nation experimenting more freely with democratic socialism. The hapless nation: France.

Views: 2,601

“To equate higher economic freedom with ‘freer rein to experiment with social democracy’ is an obvious contradiction in terms.” You seem to be denying that the countries I mentioned are social democracies. What evidence do you have for this besides to tautologically assert the above false statement? What the numbers show more readily is that you can both have a significantly stronger welfare state, stronger unions, more govt. funding for education and entitlements than we have in the United States, and have greater economic freedom. Which supports the nearly universally agreed upon fact that several of the countries on that… Read more »

The statement is neither tautological nor false. I wish it were tautological, for then it would be obviously true by definition. As it is I must labor to convince you of its truth. To be economically free means to be free of the economic dictates of the government. This is the kind of freedom the index of economic freedom measures. Therefore the more economic freedom the country has, the less government interference in the economy there is and the less room the government has to “experiment with social democracy.” You say “that several of the countries on that list above… Read more »

Haha wait a minute Charles, a tautology is merely repetitious, not necessarily correct. I responded to your article that concluded that more “free-market” countries were also more equal. I wanted to remind you that the data shows that government expenditures can be a much larger portion of the GDP than we have in the US without intruding on “economic freedom”. The data bears this out, with several of the largest governments (by percentage) presiding over healthy economies that are on par or better than the US in terms of economic freedom. I don’t want to get into a debate over… Read more »

*I meant to say “I don’t want to get into a debate over what constitutes *social democracy*”

I am quite aware that tautology means repetition when a statement equates a subject and a direct object. (That’s when the tautology is contained within a single sentence. It could encompass two sentences,) Such a statement is devoid of meaning only when the words denoting the subject and object both necessarily mean exactly the same thing. The statement acquires meaning only when subject and object do not necessarily mean the same thing, but are asserted to be the same in a particular situation, which is the case here. As you note, a tautology is not necessarily a true statement, If… Read more »

By tautology I meant that you asserted something axiomatically that I don’t believe is obvious, and therefore if I was to ask why you believe it, you might simply reassert it, because it is obvious, which would be tautological. It was not a tautology in itself, but merely a suggestion of one. The individual tax vs. corporate tax distinction is both a hugely important topic and a potential distraction, in my opinion, from the larger question of what an ideal government looks like. My point is that the simple magnitude of a government is not much of a criterion by… Read more »

In your last sentence you hit on one of most important differences between progressives and conservatives in their very different views of reality. You say “that the simple magnitude of a government is not much of a criterion by itself.” The conservative on the contrary says that once you get beyond some point of government power aggregation, below which more government is beneficial, the addition of more power to the government takes power away from individuals to rule their own lives. And make no mistake, the magnitude of government taxes and spending is power! Moreover, the conservative says we have… Read more »

In re-reading your last comment, another response occurs to me. You have noted a number of times that there are some countries that score higher in the WSJ/Heritage Foundation Index of Economic Freedom than the United States, and that some of these nations, usually European, are often reputed to intervene more in the economy. I had thought the fact they ranked higher in the index was dispositive of the claim that this was not so, but you considered my claim to be merely repetitious. How can this be, when you consider the index is constructed in such a way that… Read more »

“How can this be, when you consider the index is constructed in such a way that the larger it is, the less the overall state economic intervention must be?” When I first looked at the index, I thought 3 of the 10 criterion of the WSJ index are not monotonically correlated with less government instrusion in the economy. The first two, and then freedom from inflation/deflation. Looking at it again, I would say that none of the criterion except for, of course, taxes and government size are always monotonically correlated with smaller government, so obviously I think there is a… Read more »

An adequate response to your comment will be too large and involved to be appropriate for a simple comment reply. Look for a new post with the title A Closer Look at the Index of Economic Freedom. In the meantime you might want to take a look at the methodology used to calculate the scores, which you can find here.